In a move sure to make both shoppers and accountants smile, the cabinet has given the green light to a sparkling new initiative dubbed the “easy e-receipts” scheme. Picture this: you get to shop ’til you drop, with the added perk of saving money on your taxes. Cha-ching! This exciting announcement comes courtesy of Deputy Finance Minister Julapun Amornvivat.

Starting January 16th and stretching until February 28th next year, eligible purchases will come with a shimmering promise. These purchases will have the golden ability to be deducted from your personal income tax when you sit down to do the dreaded fiscal dance in 2026. Who knew something as mundane as a receipt could suddenly feel like a little treasure trove waiting to be unlocked?

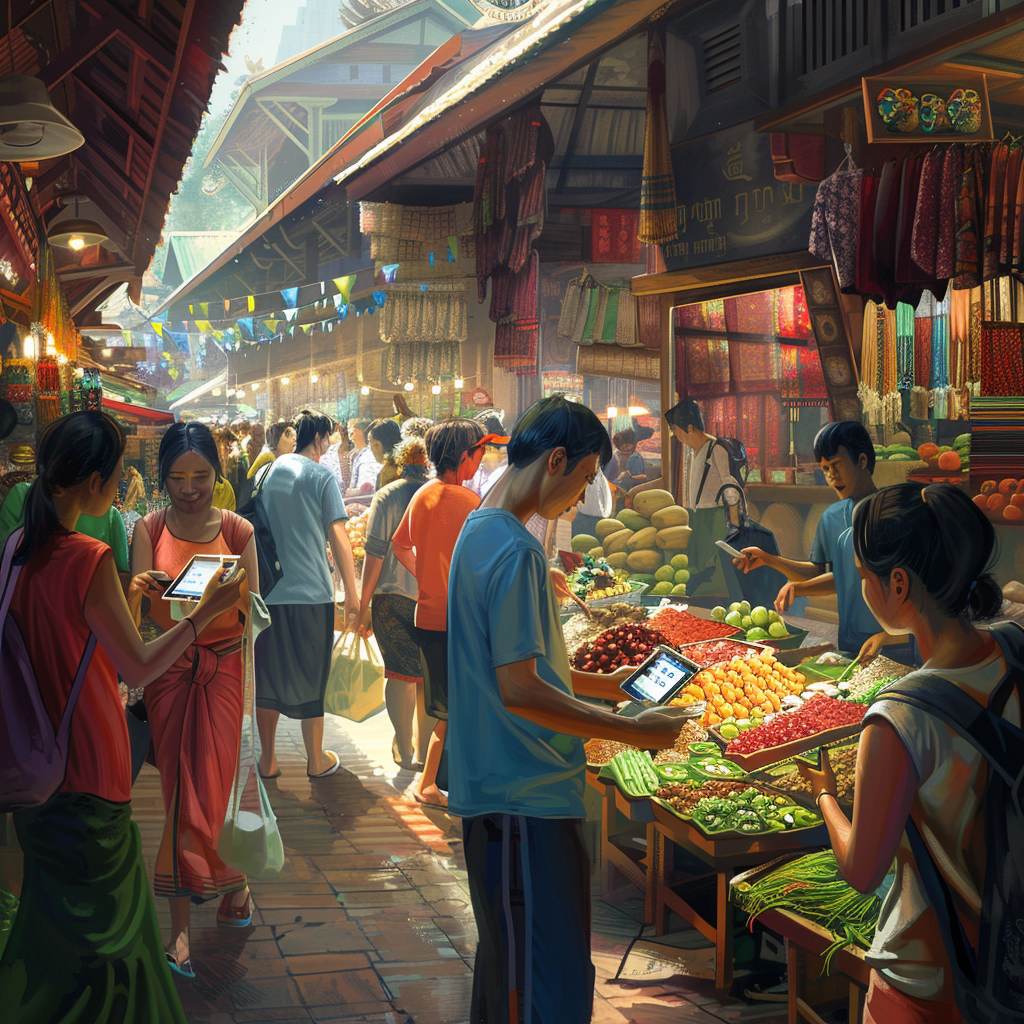

Now, before you start dreaming of tax-free adventures involving entire shopping malls, there’s a tiny catch. The joy-ride of tax deductions is beautifully capped at 50,000 baht per intrepid shopper. A slice of up to 30,000 baht could be snatched for goods sold at those bustling shops registered for value-added tax (VAT). But the adventure doesn’t end there! With a further sparkle of up to 20,000 baht waiting for those who prefer the quaint charm of community enterprise outlets or the local flair of One-Tambon-One-Product (Otop) shops.

Pause that celebratory shopping cart zoom-in on liquor aisles, though. Items like liquor, beer, tobacco, cars, insurance policies, petrol, and internet fees aren’t invited to this tax party. Sorry, bubbly beverages and snazzy wheels – you’ll have to sit this one out.

Mr. Julapun seems positively upbeat about this financial spectacle’s potential to pump up the economy, predicting an infusion of about 70 billion baht that could make even Scrooge reconsider Grinch-like tendencies. However, for those daydreaming about reimbursed sandy-bay getaways or mountain-side retreats, travel and tours are staying out of the tax deduction luggage. With the tourist season in full swing, it’s a case of “business as usual” in the travel sector.

But wait, there’s even more sizzling news! The cabinet has not forgotten its good-hearted Chewbacca impression with the second phase of the 10,000-baht cash handout initiative coming in strong. Designed for the grand folks aged 60 and wiser, who had wisely registered with the Tang Rath application. To grab this wallet-friendly handout, one needs to keep a financial lifestyle earning less than 840,000 baht a year and save not more than 500,000 baht in their bank accounts.

Slated for disbursement via the ever-handy PromtPay account system by January 29th, Mr. Julapun assures us that the handout will make its way safely to those who qualify. It’s a financial lifeline that blends a little financial relief with a dash of holiday spirit, truly a gift that’s just as good as receiving socks but way more useful!

All in all, it seems that the government is looking to add a bit of sparkle and cheer to the holiday season, making sure that everyone from the diligent saver to the enthusiastic shopper finds something to smile about before ringing in the new year.

I love the new e-receipt initiative! It’s a nice way to save while spending.

Another government trick. They give with one hand, take with the other.

But isn’t any tax relief better than none? It’s a win for conscious consumers.

Exactly! Finally something that encourages economic activity and benefits everyone. I don’t get the negativity.

50,000 baht is a good start, but why exclude cars and internet fees?

They do make a difference, especially in today’s digital economy. It seems short-sighted not to include them.

Right? Everyone needs internet these days. It’s like leaving out water in ‘essentials.’

Excluding travel from the tax deductions kind of misses the point of boosting spending, don’t you think?

It’s a shame, especially since travel can stimulate sectors across the board.

The exclusion is likely because travel already has its own set of incentives and support measures.

Why the restriction on luxury items though? Isn’t that where substantial tax revenue could be generated?

Probably because they want to focus on essential spending. Luxury items already have high taxes.

I think the focus on Otop shops is great. Local businesses need that support!

Exactly! Supporting local enterprises boosts the community as a whole.

But big stores drive the economy too. It’s about balance, not just mom-and-pop support.

Local focus is important, but we need to ensure quality and competitive pricing. It’s not just about where you buy but what you buy.

I’m curious about the long-term effects of these deductions on the economy. Temporary boosts can sometimes lead to greater unexpected costs down the line.

Short-term relief often leads to long-term scrutiny. The key is finding the balance between immediate economic stimulation and sustainable growth.

More government intervention, more bureaucracy. How about leaving some things to the free market?

Not everything can be left to the free market. We need oversight for social welfare.

This plan is definitely going to encourage more spending, but at what cost? Increased spending doesn’t always equate to economic growth.

True, Joe. We need to consider whether consumers redirect savings, invest, or just spend blindly.

Aren’t these schemes usually a hassle? Seems like more paperwork pretending to be helpful.

I think giving the elderly a cash handout is a solid move. They often get overlooked in policy changes.

Yes, seniors need that extra help, especially with costs rising. More initiatives like this, please!

Or how about we solve rising costs instead of just handing out temporary relief?

True, CriticCarol, but until a long-term solution, this is at least something concrete.

How will you even prove these so-called tax savings without keeping track of every electronic transaction? This is prolly just more tracking disguised as savings.

The adoption of electronic records allows for efficient audit trails. This can ultimately minimize fraud.

Does anyone know if student expenses will be deductible?

From what I understand, no specific mention but check official updates for full details.

So what’s next? More schemes micro-managed by those who can barely balance their own budgets?

That’s unfair, Jim! Some policies do work to improve fiscal health—the intention is support, not micromanagement.

I’ll just stick to my cryptocurrency. The government’s games here sound too complicated.

Good luck with volatility! Government schemes are complex but designed for widespread assurance.

Can someone explain why they won’t help with car expenses? Feels like they pick and choose which industries to support.

Likely because car expenses are huge segments with distinct policies already in place. It’s about broader inclusion across sectors.