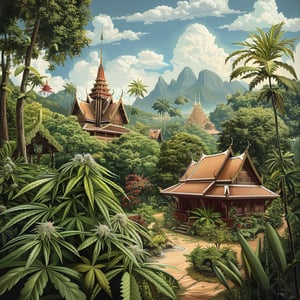

Amidst an atmosphere charged with anticipation and strategy, a vital discussion transpired under the banner “Co-creating and Developing the Capital Market to Drive the Country Towards Sustainable Growth” – a dialogue set to shape the very skeleton of Thailand’s financial future.

Imagine the buzzing undercurrents of that Thursday, where the very architects of fiscal transformation congregated to unveil the blueprints of the SEC’s 2024 strategic roadmap – a game-changer slated to revolutionize the supervision and democratization of Thailand’s capital market. The mission? To craft a market accessible to each and every individual.

SEC Secretary-General Pornanong Budsaratragoon, ever the beacon of determination, asserted the commission’s steadfast commitment to this inclusive vision. Painted against the backdrop of economic headwinds, Budsaratragoon’s conviction was unyielding. The capital market, she contended, had to ascend to its rightful role as the lifeline for business support and a bastion for Thai savings alike.

With breathtaking boldness, the SEC’s manifesto unfurled: advancing regulatory frameworks, harnessing cutting-edge technology within the SEC ecosystem, bolstering SEC’s own capabilities, enforcing regulations with an ironclad grip, incubating a nurturing habitat for burgeoning digital assets, championing green and social ventures, and eradicating any hurdles that may arise.

“Trust and confidence,” Pornanong heralded, “are the keystones we shall restore.” In her grand vision, Thailand’s marketplace would turn into an irresistible allure, calling forth a mélange of international investors, founders, bright-eyed entrepreneurs, and dynamic startups.

As the doors to this rejuvenated capital market swing open, they reveal a kaleidoscope of financial options for the discerning investor. All this innovation, all this transformation, springs forth in the wake of a year marred by a crisis of conviction – where the disconcerting shadows of fraud and misconduct loomed large.

The Stark Corporation scandal clung to headlines like a dark cloud—15.6 billion baht of inscrutable transactions unveiled, shaking the very foundations of the market, all precipitated by a whirlwind of accounting scandals and debt defaults.

The chairman of the Federation of Thai Capital Market Organisations (FETCO), Kobsak Pootrakool, echoed the resolve to spearhead two transformative shifts: the resurgence of trust and a thrust towards modernization. As FETCO stood firmly by the SEC’s side, the gears of change whirred – with the blueprinting of special analyst teams to critique and vanguard the small cap stock sector.

“We’re assembling experts poised to dissect and deliver verdicts on all small cap stocks,” asserted Kobsak, shedding light on a path designed to guide investors to make enlightened decisions, while nudging companies towards ethical play. The spotlight would soon illuminate the overlooked enclaves of the market, financed by a potential 20 million baht from the Capital Market Development Fund (CMDF).

The SET’s very own Pakorn Peetathawatchai, vested in the mission, pledged an alliance with the SEC tailored to elevate the market’s stature. Partnerships already in place to uplift financial literacy were just the beginning, he hinted – the horizon promised a concerted effort to foster a robust and sustainable capital landscape.

The country’s Prime Minister, Srettha Thavisin, didn’t just observe from the sidelines. He came forward with three strategic aces designed to rekindle the once-vibrant capital market. As he put forth initiatives centered on finessing free trade agreements, orienting towards sustainability, and stimulating private sector fundraising, he underscored the SEC’s cardinal role in powering through to a digitized economy.

Indeed, the tapestry of Thailand’s economic revival is being woven, thread by thread, with these steadfast stewards at the helm. With each word and each policy, they aspire to weave a financial fabric that’s not only resilient but redolent of the rich tapestry of Thailand’s vibrant future.

Be First to Comment