Embracing its status as an ageing society in the previous calendar year, Thailand, as showcased in a seminar held last week, now identifies over 20% of its population, approximately 12.9 million individuals, as 60 years of age or older. Yet, a comprehensive and ample welfare program tailored for this age group remains a need unmet, as was observed by the event’s four collaborated sponsors – the resolute Thailand Consumer Council, the people’s champion for hired help – the Welfare State Network for Equality and Fairness (We Fair), an influential academic body – Chulalongkorn University’s Faculty of Economics, and the People’s Network for the Welfare State, a bastion for grassroots rights.

At present, Thailand’s social welfare system grants a monthly allowance, ranging between 600-1,000 baht, to those individuals aged 60 and above. However, this provision faced a contingency after August 12 of the current year, as the state pension became restricted to only those seniors who have little to no monthly income sources. This alteration has been a point of intense discussion at the seminar.

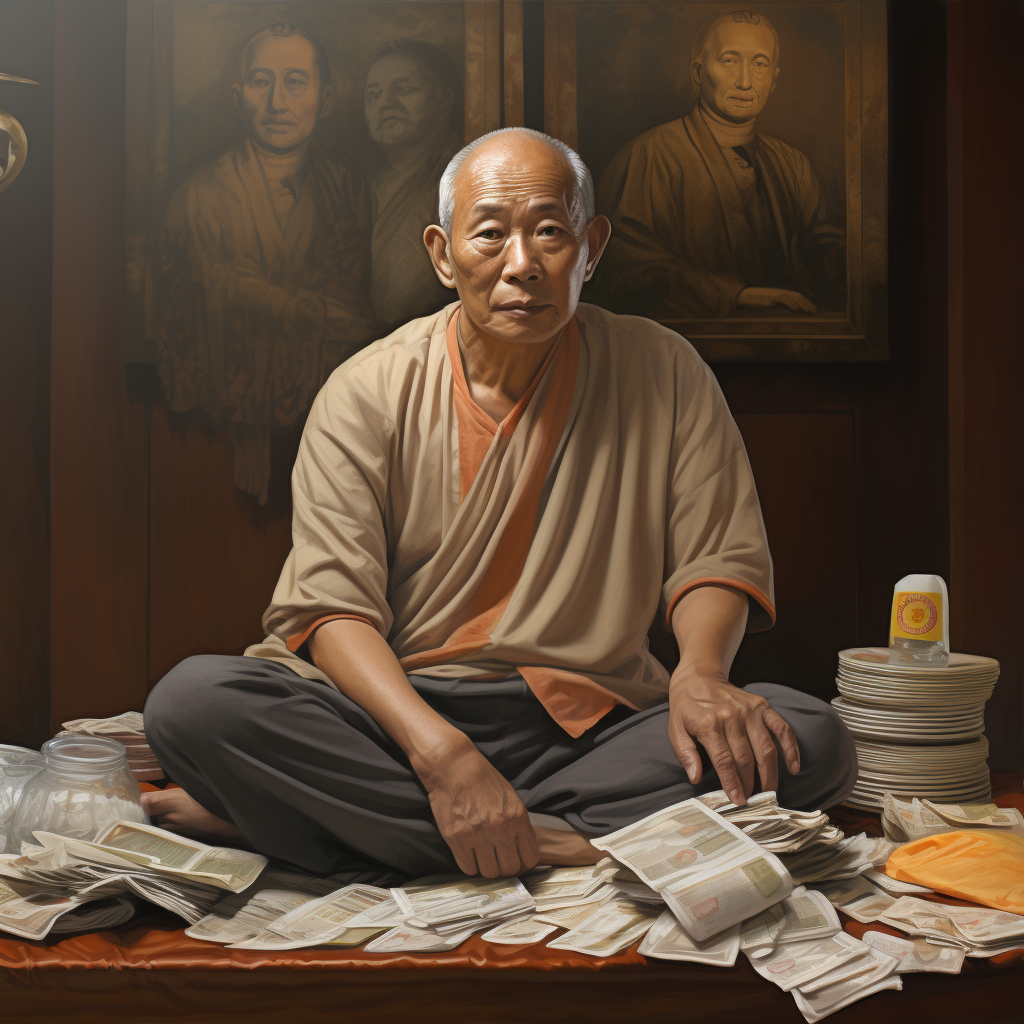

The seminar outlined the stark reality that compels the majority of the Thai elderly, in the age group of 60-69, to cling on to the workforce for meeting their personal debt obligations. Regardless of whether they are the recipients of the state pension or not, they are most often engulfed by debts that are to settled, leading to them being left with highly limited funds for their day-to-day sustenance. The study reiterated the financial adversity faced by a large portion of the elderly demographic who lack personal savings and are saddled with debt that extends beyond the formal, mainstream financial system.

A recently conducted study unveiled a startling statistic that almost 90% of Thai senior citizens do not possess personal savings. In response, seminar participants have voiced their opinions, persuasively arguing that the state pension scheme should be broadened beyond its current reach rather than being limited. They propose that the state pension rate should be increased to a monthly remittance of 3,000 baht for all recipients, suggesting it as a feasible approach to not only alleviate the financial burden among the elderly, but also as a stimulus to energise the Thai economy.

Be First to Comment