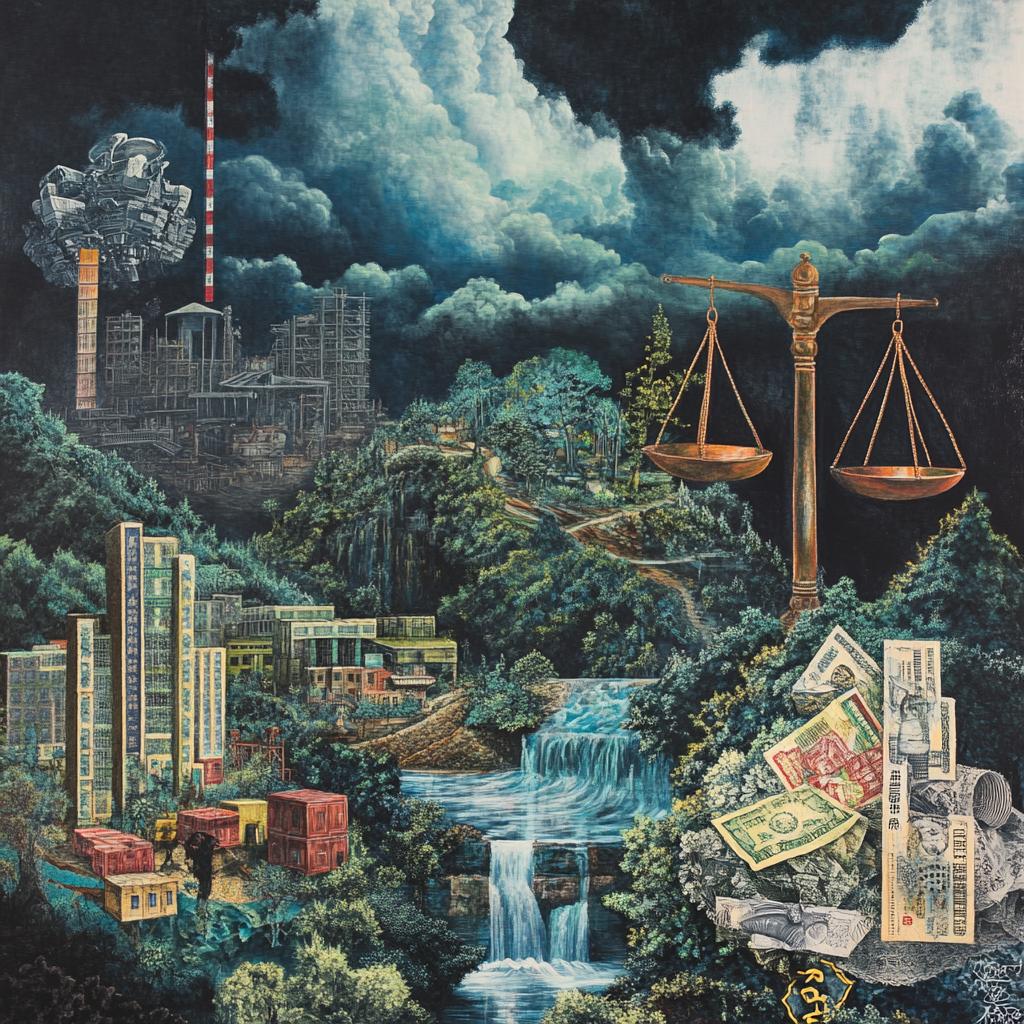

As the world spins with ever-changing economic dynamics, Thailand stands at a pivotal crossroads. The country is witnessing a rising tide of what industry experts call “zero-dollar” investments and exports, notably flowing from the outbound trade powerhouse, China. But what exactly does this mean for the Land of Smiles, and more importantly, for the Thai people?

Amonthep Chawla, the astute chief economist at CIMB Thai Bank’s Economic Centre, warns of stormy skies ahead unless decisive action is taken. The backdrop to this warning is painted by the latest tariff strategies deployed by the United States. Broad-reaching tariffs and specific measures targeting Thailand are accelerating a seismic shift in global trade patterns, unsettling the long-standing economic dance between the US and China.

As global superpowers recalibrate their economic strategies, Southeast Asia, and particularly Thailand, is emerging as an attractive suitor for foreign direct investment (FDI). With its rich tapestry of potential, Thailand could very well blossom into a critical manufacturing nucleus, serving both local and international markets. There’s just one snag – not all that glitters in the realm of FDI is truly golden.

Amonthep issues a word of caution: many investments resemble mirages rather than fertile oases. Specifically, the influx of zero-dollar ventures from Chinese investors poses a significant challenge. These investments and exports tend to offer negligible economic value, often entailing goods that are produced in Thailand but yield scant returns in terms of local employment or economic enrichment.

2024 marked a record-breaking year for FDI in Thailand, yet the accompanying metrics tell a less rosy story. The Purchasing Managers’ Index (PMI) showed only a slight rise, while job growth largely treaded water. Despite exports soaring into double-digit growth figures, the economic impact remained tepid at best.

Export growth, as touted in press releases, has not cascaded down into tangible economic benefits because the actual contribution to local industries and employment remains modest. Amonthep is urging the government to tackle these zero-dollar operations with the vigor once reserved for dismantling exploitative zero-dollar tour schemes, where Chinese tour operators pocketed profits while leaving locals virtually empty-handed.

This call to action resonates like a clarion call for policy change as Thailand’s economic future hangs in a precarious balance, overshadowed by geopolitical shadows. Though former US President Donald Trump temporarily shelved a hefty 36% tariff on Thai goods, the looming specter of a universal 10% tariff continues to eke away at economic security, creating an air of unease.

The outlook is cloudy. CIMBT has adjusted Thailand’s GDP growth prediction for 2025, lowering it from 2.7% to a sobering 1.8%, coupled with a meek anticipated export rise of only 1.4%. While a full-scale recession isn’t quite etched in stone, the risks of an economic deceleration in the later quarters are increasingly likely.

In an effort to soften these economic blows, the Bank of Thailand is expected to trim its policy rate again, potentially plummeting it from 2% to a mere 1.25% by the year’s end. Further rate cuts loom on the horizon. As for the Thai baht, financial tranquility remains elusive. Anticipated to depreciate further against the dollar, the baht is burdened by diminishing capital inflows and slowing tourism revenue, possibly slipping to 35.20 to the dollar by year’s end.

With this backdrop of global uncertainties and questionable foreign investments, Thailand’s economic narrative seems ripe for a dramatic twist. The country’s path forward hinges on strategic foresight and assertive policy-making, to cut through the haze and usher in a broader, more equitable prosperity for all Thais.

I don’t understand why people are so worried about these ‘zero-dollar’ investments. Isn’t any investment better than no investment at all?

But Samantha, these investments don’t benefit local communities. They’re just smoke and mirrors with no real economic value.

I see your point, but surely there are long-term advantages, like infrastructure development?

The long-term advantages are minimal if at all. What’s the point of building infrastructure if it doesn’t actually create jobs or economic growth for locals?

It’s naive to think Thailand won’t be severely affected by these economic shifts. The government needs to take firm action!

Don’t you think, in the midst of all this economic turmoil, we should be focusing on local industries rather than courting these risky investments?

Absolutely. Local industries are the backbone of the economy. We rely too much on foreign investments, and it makes us vulnerable.

But Joe, local industries often rely on foreign partners for resources and tech. It’s a globalized economy now.

The zero-dollar investment issue feels like the zero-dollar tours all over again. We need to learn from past mistakes, folks!

Exactly, Simon! And we need strict regulations to prevent exploitation again.

Agreed, Jade. Regulations can only work if they are enforced properly though.

Let’s not panic just yet. Predicting economic doom seems premature. The government can still turn this around by taking strategic steps.

Isn’t the problem partially because of over-dependence on exports? Economies should diversify!

Exactly Kamal, but how do you diversify when foreign investments want quick returns, not long-term growth?

We need a transition plan from export dependency, which is easier said than done.

Everyone’s talking about policy changes, but no one’s mentioning education. We need to educate our young talents to drive future growth!

I think Amonthep is right to warn us. The economic signs are worrying, and we need to pay attention.

Spot on, Richard. But raising alarm without actionable solutions only adds to the panic.

Don’t forget, if the baht depreciates more, tourism might boost as it’s cheaper for foreigners to visit.

Technology investment would help buffer these economic shifts. Thailand needs to become an innovation hub!

True, but tech communities need incubation time and a conducive environment. It’s not a quick fix.

Why blame China entirely? It’s up to us how we negotiate these investments.

An interconnected world means these problems will always have ripple effects. We need international collaboration.

Collaboration’s great in theory, but in the real world, countries protect their own interests first.

True, Yasmin. That’s why we need leaders with vision to see beyond immediate nationalistic gains.

All this speculation is just exhausting. Let’s focus on the facts and not get swept up in hysteria.