The story of Theephat Liangwatthanatham, a 43-year-old former bank employee, is nothing short of a twisted crime novel. On a rather unremarkable Tuesday, Theephat was caught red-handed with his mobile phone in front of a convenience store in Muang district of Phitsanulok. Despite the mundane setting, the charges against him were anything but ordinary. This arrest was the culmination of a convoluted saga involving fraudulent loan and auto leasing contracts, and it became the talk of the town.

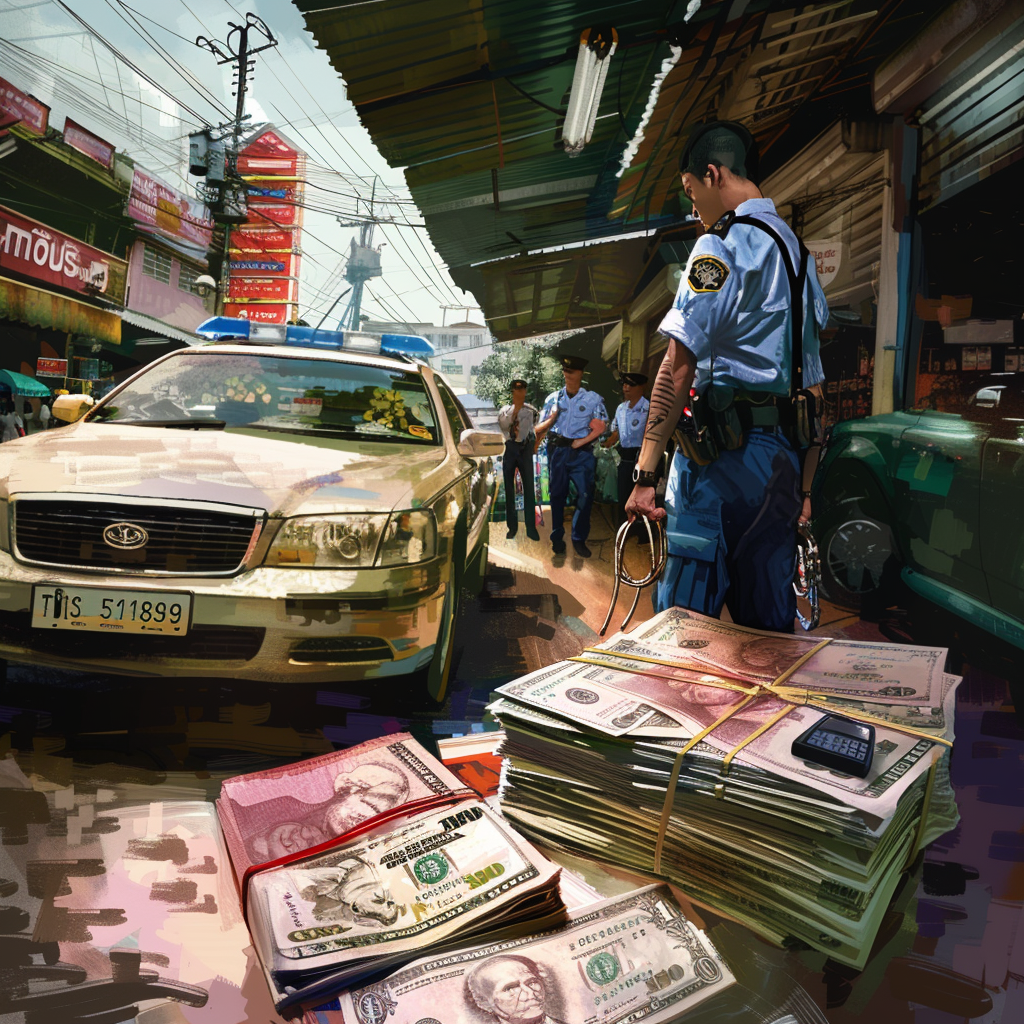

Pol Col Sanuwong Khongkha-in, the superintendent of sub-division 4 of the Anti-Corruption Police Division (ACPD), couldn’t have been more pleased. According to him, the suspect’s misdeeds were well-documented and now well-contained. The details of the story began to unravel swiftly after Theephat was apprehended. Apparently, back on November 28th of the previous year, the Central Criminal Court for Corruption and Misconduct Cases had issued an arrest warrant for Theephat. The charges? Malfeasance causing significant detriment to an organization or a state agency.

Theephat’s tale began in the leasing department of a renowned bank, whose identity remains shrouded in mystery. It seems he had a penchant for getting creative with auto leasing documents. His partner-in-crime was a friend who owned a used-car tent business. Together, they orchestrated a grand scheme. He allegedly doctored auto leasing contracts from other car tent businesses and adapted them for his friend’s enterprise, raking in lucrative commissions along the way. Not stopping there, he is said to have siphoned off portions of the loans earmarked for customers, lining his own pockets with the ill-gotten gains.

When questioned, Theephat didn’t hesitate to spill the beans. According to him, his decade-long stint as a loan officer at a commercial bank had provided him with an education in identifying and exploiting legal loopholes. However, things took a desperate turn when he transitioned to working for a state enterprise bank. Struggling with mounting football gambling debts and financial woes at home, Theephat made a fateful decision. He began falsifying documents, diverting bank funds to settle his debts. This one-lane trip to financial salvation ended disastrously, resulting in his termination from the bank and a three-year stint behind bars.

But Theephat’s story didn’t end there. He further entwined himself in deceit by borrowing credit cards from friends and neglecting to repay his dues. Eventually, he decided to change his name and embark on a life on the run. However, as fate would have it, this desperate bid for freedom was a temporary reprieve at best.

The tale took a further dramatic turn when the offences outlined in the arrest warrant dated back to 2013. So impactful were his actions that they left the bank facing losses exceeding one million baht. Theephat’s calculations may have been precise when it came to exploiting loopholes, but he underestimated the long arm of the law.

The arresting team, having captured their elusive target, promptly handed Theephat over to the Central Criminal Court for Corruption and Misconduct Cases. As he now awaits his fate, Theephat is a cautionary tale – a stark reminder that, while you may run and hide, eventually, the law will catch up with you.

Wow, this story is like a real-life crime novel! I can’t believe someone with his experience in banking would risk it all for fraud.

I think it’s less about experience and more about desperation. Gambling debts can push people to do crazy things.

True, but he could have sought help instead of spiraling into more crimes. Now he’s lost everything and ruined other lives in the process.

I feel sorry for his victims. Imagine trusting your financial advisor only to find out they’re a crook.

Absolutely! It just shows you can’t trust anyone these days. Banks should have better oversight.

It’s mind-boggling how he managed to pull off these schemes for years without getting caught! Makes you wonder about the internal controls of that bank.

Internal controls often fail because they rely on the integrity of employees. No system is foolproof against someone determined to exploit it.

So true, but it feels like they should’ve caught on sooner, especially with such large amounts of money involved.

This guy is just a symptom of a bigger problem. The banking system is full of loopholes for those who know how to exploit them.

I wonder what his friend with the used-car business is doing now. They should get investigated too!

Changing his name and running away was such a dramatic move, like something out of a movie.

Yeah, but it didn’t work out in the end. The law always catches up eventually.

What a waste of talent. He probably could’ve used his skills for good if not for his crippling debts.

This story just reinforces my belief that the banking sector is full of corruption.

Not all bankers are corrupt. There are bad apples everywhere, but most are just trying to do their jobs.

The downfall started with gambling debts. Reminds me of countless historical figures who lost everything due to gambling.

It’s sad to see how financial pressure can drive people to such extreme actions. We need better financial education and support systems.

I can’t believe he thought he could keep getting away with it indefinitely. The arrogance is astounding.

People often get blinded by success and think they’re untouchable until reality hits hard.

Classic case of white-collar crime. What’s shocking is how long it took for him to get caught.

His life is ruined now, but he ruined many lives in the process. Hard to feel too sorry for him.

Exactly. While he had troubles, he chose to treat others unfairly to fix them. No sympathy here.

The sad part is that his story isn’t unique. Many people in the finance sector end up taking similar paths due to mismanagement of personal finances.

This story is mind-boggling on so many levels. He thought changing his name and running would save him?

To be honest, I’m more surprised at how poorly the internal control systems worked in that bank. They should be held accountable too.

Seriously! The bank’s failure to catch this sooner speaks volumes about their internal oversight.

What’s even worse is how his actions brought down so many people who trusted him.

Yes, the ripple effects of his crimes are tragic. He’s not the only one paying the price.