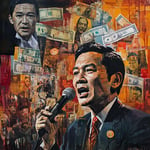

In a world where financial headlines often read like a thriller novel, Wiroj Lakkhanaadisorn, the dynamic deputy leader of the People’s Party, has set tongues wagging with his latest revelation. During a fiery opening salvo at the censure debate, he accused Prime Minister Paetongtarn Shinawatra of dodging taxes to the tune of a whopping 218.7 million baht. But let’s put the scandal aside for a moment and delve into the intricate web of gift tax regulations that have us all curious. Strap in, folks, this financial rollercoaster is about to set off!

You see, in the fascinating realm of the tax code, there exists a little-known creature called the gift tax. It’s the financial guardian meant to thwart any sly attempts at skirting inheritance tax. Introduced on the scene on February 1, 2016, this tax casts a watchful eye over assets whisked from one lucky individual to another, be it children, spouses, or even that long-lost third cousin who suddenly appeared at the family reunion. The basic rule of thumb? If you’re passing on more than the free-for-all limit, you’ll get a tickle from the taxman.

Interestingly, there’s a societal twist to this tale. Ascendants and descendants have been lined up to play key roles. Imagine ascendants as your esteemed parents, doting grandparents, and perhaps the ever-revered great-grandparents, tracing both paternal and maternal trails. Descendants, on the other hand, are the lively bunch that includes children, grandkids, and those exuberant great-grandchildren. It’s like casting a family sitcom where everyone has a part to play!

Now, on to the central question: who’s footing the bill? If we’re talking immovable assets, the weight of the wallet lies with the individual transferring ownership. So, if parents decide to hand over the keys of that swanky condo to their legitimate offspring, they’re the ones feeling the tax pinch. As for movable assets, the script takes a twist. Here, the lucky recipient gets to pick up the tab, but only if the present exceeds 20 million baht. There’s a sleuth-like precision to these numbers, akin to a detective uncovering hidden clues.

As every great drama needs its highlight, here come the tax rates with their numbers poised to astound. For immovable assets, gifters pay a 5% tax on any portion surpassing the magical 20 million baht mark at the land office. Consider it akin to leaving a 5% tip for the tax office’s impeccable service. As for movable assets, it’s a 5% bite for anything over 20 or 10 million baht, depending on how closely you hold the giver.

And if you’re thinking outside the box and your situation doesn’t quite tick the above boxes, fear not! The government is ever-ready to accommodate with a progressive personal income tax rate that scales from 5% to a jaw-dropping 35%, depending on how full your pocket is from other income sources.

Oh, what a tangled tax web we weave! While Wiroj’s bold accusations ignite riveting discussions on ethical governance and tax justice, perhaps the heart of the matter settles on understanding the taxes that tie us all together in this financial tapestry. So, next time you unwrap a present and find yourself pondering, remember, behind each gift could be a story as intricate and riveting as any political thriller.

Wiroj’s claims are disturbing if true. It’s outrageous for anyone in power to dodge taxes, let alone the Prime Minister!

Accusations are one thing, but proof is another. Let’s not jump to conclusions before the facts are out.

You’re right, Tom. I just think leaders should be held accountable. It bothers me that this could be happening.

But isn’t it always the same story? Politicians are rarely held accountable in the end.

Understanding Thailand’s gift tax intricacies is crucial. Many countries lack such specificity in their regulations.

Does anyone else find this gift tax stuff confusing? Like, how do they even keep track of all those transactions?

It can be complex, especially for international transactions. Systems are in place to trace significant transfers.

Steve, taxes are a headache anywhere. I guess that’s why we need tax professionals!

The gift tax seems fair. It prevents wealthy individuals from dodging taxes by transferring assets under the rug.

True, but there’s a fine line between ensuring fairness and over-regulating personal finances.

Absolutely, Larry. Balance is essential. But without regulations, loopholes will always be exploited.

Don’t you think tax laws are just another way to control us?

How can we trust any government if they perpetually allow ‘done-deals’ like these to slide under the radar?

You know, the gift tax is much like a hidden exam we never prepared for – people barely know it until they’re caught.

Seems the rich never really ‘pay’ like us ordinary folk do, if these accusations turn out legitimate.

Kind of amazed at how little I knew about Thailand’s tax codes. Every piece of legislation seems to weave its own story.

I feel for the honest taxpayers while others continue to find loopholes. It’s just unfair.

Yep, life’s not fair. That’s why we must push for transparency in governance.

I agree, Gillie. Transparency is the only way to ensure justice in tax laws.

I’m curious if these claims against the PM lead anywhere substantial or if it’s just political drama.

Tickle from the taxman? It’s more like a harsh slap when it hits your bank account!

Haha, Howard! You’re right, taxes aren’t exactly gentle.

Isn’t it odd how tax laws seem complex intentionally, almost pushing people to find loopholes?

I wonder how other countries handle similar situations. Is there someone doing it better?

A tangled web, indeed! Will we see a new tax reform trend emerge globally from such debates?

Global tax reform has been on the agenda for years, but real change is slow, Tim.

With so much complexity, it’s a wonder how anyone can keep their finances on the straight and narrow.