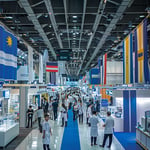

Informa Markets is gearing up to make CPHI South East Asia 2024 the cornerstone of Thailand’s ambitions to become a leading medical hub in the region. Set to take place from July 10-12, 2024, this pivotal event will be held at the prestigious Queen Sirikit National Convention Centre. It promises to be a gathering of industry experts, including top-tier manufacturers, scientists, researchers, pharmacists, and distributors, representing 21 countries.

Ms. Rungphech Chitanuwat, Regional Portfolio Director for ASEAN at Informa Markets and Country General Manager for the Philippines, shared candid insights with Thansettakij about the burgeoning trends in both the global and Southeast Asian pharmaceutical markets. According to her, several key factors are contributing to this positive outlook. The aging population, the increasing prevalence of non-communicable diseases (NCDs) like heart disease, hypertension, and diabetes, and favorable policies promoting medical tourism are among the primary growth drivers.

Healthcare systems across Southeast Asia are varied, yet many countries in the region heavily rely on imported medicines—predominantly from Thailand. Although none of these countries are international producers of patented drugs for complex ailments such as cancer and epilepsy, they focus on producing generic medications by importing Active Pharmaceutical Ingredients (APIs) mainly from China, India, and certain European nations. Most patients access patented drugs via their respective health security systems.

Thailand stands out with a mighty medical market valued at 2.25 billion baht, making it one of the most lucrative markets in the region. The nation’s potential is amplified by its robust government health security system, which makes pharmaceutical products more accessible and affordable. Additionally, Thailand’s strategic plan to position itself as Asia’s medical hub is set to attract a significant number of patients and medical tourists, creating a surge in opportunities for local Micro, Small, and Medium Enterprises (MSMEs).

“Thailand has tremendous potential to evolve into a medical hub, owing to its cost-effective prices, high-quality service, and skilled professionals in the industry, including those in alternative medicine and rehabilitation,” noted Rungphech. “However, it’s important to note that about 65% of the medicines consumed in Thailand are imported, and local production accounts for only 35%. The production of upstream pharmaceutical products, raw materials, and mid-stream products remains minimal.”

To realize its ambition of becoming a medical hub, Thailand will need strategic investments, especially in biopharmaceuticals, biosimilars, biotechnology, and advanced medical equipment. The country also needs to elevate hospital quality and human resource capabilities. Local production of advanced medical equipment, like robotic surgery tools and vital signs monitors, is still in its nascent stages and requires significant development.

CPHI South East Asia 2024 is set to be a catalyst for these developments, fostering pharmaceutical security while promoting the healthcare industry and overall economic growth. This year, the event will run concurrently with Medlab Asia & Asia Health 2024, ASEAN’s premier medical laboratory and healthcare exhibition and congress. Both events aim to spotlight the immense potential of Thailand’s pharmaceutical industry to an international audience.

Under the theme of International Healthcare Week, CPHI South East Asia 2024 aims to bring together key APIs from various countries, enhancing access to innovative raw materials and unlocking new business opportunities for Thai enterprises. Interested parties are encouraged to register in advance at https://www.cphi.com/sea.

Thailand becoming a medical hub sounds promising, but what about the local talent? Can they keep up with such an ambitious plan?

I agree, Sarah. Local talent doesn’t just appear overnight. It takes years of training and investment.

Absolutely, John. And with only 35% of medicines produced locally, it doesn’t seem like they’re quite ready for this leap.

Let’s not underestimate Thailand’s existing medical schools and training facilities. They are constantly improving.

Developing talent also requires attracting experts from abroad. I wonder if Thailand is prepared to offer competitive packages.

This sounds like it’s more about business than actually helping people. Medical tourism always seems to prioritize profit over patient care.

Grower134, isn’t that the case with any industry? But I do think it can still benefit the local population with better healthcare infrastructure.

True, Kelly, but medical tourism can also drive up costs for locals. It has its downsides.

Let’s be real, if it boosts the economy, it’s a win-win. Higher GDP means more government spending on healthcare.

But the ethical implications can’t be ignored. Prioritizing international patients might leave locals at a disadvantage.

The emphasis on biopharmaceuticals is a smart move. The global pharma market is huge with endless opportunities.

True, Sam! But are there enough regulatory frameworks in place to ensure quality and safety?

Great point, Vicky. Without stringent regulations, this could backfire spectacularly.

Hosting an event like CPHI is good PR, but is that enough to change the entire sector?

Rob, large-scale events can attract investment and innovation, laying the groundwork for long-term improvements.

Perhaps, Megan, but foundational changes are needed. The focus should be on persistent development, not just one-time events.

65% of medicines are imported? That’s a huge dependency on other countries. Thailand needs to beef up local production.

Larry, it’s all about economies of scale. It’s cheaper to import than to produce everything in-house.

Fair point, Chris. But in times of global crisis, dependency can become a major vulnerability.

Imagine if another pandemic hits, and borders close. Local production ensures a steady supply chain.

Exciting times for Thailand! Medlab Asia & Asia Health 2024 running simultaneously with CPHI should draw a lot of attention.

Skeptical about the potential outcomes, but this could bring a much-needed economic boost.

In terms of cost-effective prices and high-quality service, Thailand has already shown great potential in the medical tourism sector.

Importing APIs from India and China isn’t a bad idea. They’re known for cost-efficiency and quality.

True, Ankit, but it put Thailand at the mercy of these countries’ political and economic stability.

Diversification of import sources could be a solution here. Don’t put all your eggs in one basket.

I wonder how ready Thailand’s healthcare system is to handle an influx of international patients.

Great strategic plan! If executed well, it can solidify Thailand’s stature in the global medical market.