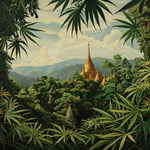

In a tranquil corner of Chiang Mai province, a story unfurls that has the makings of a modern-day drama. Meet Chandi, a 57-year-old hill tribe woman who is caught in the whirlwind of an alleged banking scam that has ensnared her in a web of debt amounting to nearly 300,000 baht (around US$8,680). This tale spins around a community that reigns not only against the lush backdrop of Mueang subdistrict, Bo Kaew district but also grapples with the stark lines of justice and bureaucratic rigor.

Our story takes its first turn on a crisp morning, where Siripong Nampha, freshly minted as the district chief of Samoeng, takes charge. The scene is set with a visit to Chandi’s humble abode on January 15, 2025. Accompanied by a retinue of local officials, Nampha is on a mission: to untie the knot of confusion that binds Chandi and her 64-year-old husband, Jorpo, both of whom have never learned to read or write. The couple’s life, already shadowed by Chandi’s battle with cancer, is further darkened by this financial conundrum.

The plot thickens as Chandi recalls signing what she thought was a straightforward loan document back in the day, in 2009. Little did she know, this agreement was the slippery slope to a burgeoning debt she claims she never benefited from. According to Chandi, instead of the 5,000 baht (approximately US$145) she expected, her name became wrongly associated with a dizzying 150,000 baht (US$4,342) withdrawal. Yet, she affirms receiving no baht from this phantom transaction.

Enter Dee, the enigmatic leader of the loan group in question. As the orchestrator of several financial groups, Dee maintains that all necessary signatures were collected to seal the deal, yet he professes ignorance regarding Chandi’s alleged withdrawal. According to him, members, including Chandi, were part of a mutual guarantee scheme where each borrowed 150,000 baht. The mystery heightens as he explains the procedures necessary for these loans, a labyrinthine process that demanded sign-offs both within bank walls and beyond.

The banking world steps into the limelight with a representative explaining what needs to happen for a loan to occur. They elaborate on the essential presence of the account holder for document signing and identity verification during withdrawals. Yet, unraveling the threads of this mysterious 150,000 baht withdrawal requires more than just surface-level checks. Private banking law constraints mean that an official request is needed to delve into the pertinent loan documents and signatures involved.

Chief Siripong Nampha, with the vigor of someone just days into their tenure, insists on cutting through the clutter to get to the heart of the matter. Speaking with assurance, he vows to retrieve missing documents such as withdrawal records and loan contracts—keyplayers in untangling this storyline. The district’s Dhamrongtham Centre is positioned as the stage for possible resolution talks with the bank forces, loan group members, and even local leadership to sift through facts and bring clarity to the Chandi saga.

Within this intricate narrative, Chandi’s plight has been exacerbated by prior attempts—frustrating as they were—from bank officials aimed at coaxing her into shouldering the debt. Her steadfast family refused these offers, fostering a mistrust that Chandi couldn’t overlook, thus pushing Siripong himself into the field of action. Reports align with her claims: there’s a discernible absence of her signature in her initial bank book. Surely a poignant symbol of an action that never took place—the depositing and immediate withdrawing of 150,000 baht in a single swift stroke of 2009.

The denouement of this tale promises to be determined by what the bank can provide: tangible evidence, documents that speak in ink and paper to Chandi’s dispute. It’s a dramatic dance toward justice, as financial disclosures to the probing eyes of the Dhamrongtham Centre may illuminate the course of necessary legal action. Until then, the curtains hover, awaiting the culmination of an investigation that bridges culture, vulnerability, and the promise of rightful resolution.

As we await the next act of Chandi’s unfolding drama, one thing’s for sure: in the bucolic calm of Chiang Mai’s landscapes, the search for truth cuts a deep and unwavering path.

Sounds to me like they should have never signed anything without understanding it first. This is why education is key!

True, but it’s not always that simple. Access to education isn’t universal and should be a focus for communities everywhere.

I get that, but if you’re going into something involving money, you need to be cautious and maybe get someone who understands to look at it.

This sounds like another case of the system taking advantage of vulnerable people. Why didn’t more alarm bells ring sooner?

Probably because the system doesn’t really care about small individuals like Chandi until it gets media attention.

So sad, really. These institutions should bear more responsibility towards honest, vulnerable people.

Why is nobody talking about the possibility that Dee might be involved in some kind of scam? His explanation seems fishy.

I agree. If his group orchestrated the loan, he might know more than he’s letting on.

I think the authorities need to focus on finding out what really happened to the money.

This would never happen here in the States. Banking laws are way too tight.

u dumb? read the news

This story feels like a scene from a soap opera, but it’s all too real. Financial literacy is critical!

It’s a Human Drama, one that reveals societal gaps more than entertainment.

I think the investigation will uncover more corruption than anyone expects. Chandi might not be alone in her plight.

You’ve got a point. It’ll be interesting to see who else might be affected.

The real issue here is trust. Once that’s broken, it’s hard to repair, as Chandi’s experience shows.

What about Chandi’s health? Cancer and stress from this scandal…it can’t be good together.

I hope the bank takes responsibility for their ‘oversight’. Everyone deserves dignity and respect.

Dee says all signatures were collected, but what if this was all set up to exploit people like Chandi?

It’s possible, but we should wait for the investigation to unfold before making conclusions.

There’s always two sides to the story. We haven’t heard from the bank, let’s not prejudge.

Legally, it’s all about documentation. No signature should mean no loan transaction on record.

I wonder if this story will lead to some substantial policy changes or just be swept under the rug.

Chandi’s story is a call for action. We need to push for transparency within these financial systems.

Many truths lie in this saga, all we can hope for is a fair resolution with all evidence considered.

I can’t help but feel sad for the whole situation. People should be held accountable.

At the end of the day, it’s about making sure no one else falls victim to the same trap.

Chandi’s case emphasizes the need for legal consumer protection for vulnerable populations globally.

Absolutely! And local communities must voice these injustices to spark change.

I’d love to see follow-up stories on these types of situations. The story shouldn’t end here!