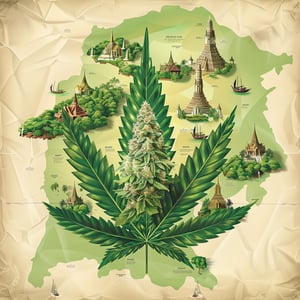

Amid the serene backdrop of Thailand’s eastern province of Rayong, a drama unfolds that feels all too familiar in today’s world. Meet Kanlayaphat, a spirited 50-year-old who recently found herself at the center of a disheartening tale begging for justice. Her crime? Trusting too easily—a trait the unscrupulous exploit with vigor. Her fortune, all 1.7 million baht of it, intended as her safety net for retirement, vanished in the blink of an eye. Her story, a cautionary tale, unveils the layers of bureaucracy that seem to wrap themselves around even the most straightforward cases when help is most needed.

April—often a time for renewal and hope—turned into a season of despair for Kanlayaphat. It all started with a deceptive message purporting to be from the Provincial Electricity Authority (PEA), which arrived in those early morning hours when vulnerability is at its peak. According to the message, she defaulted on her electricity bill for two whole months. Inkling it was an error—after all, who enjoys leaving bills unpaid?—she reached out to the PEA, confident in her financial diligence. The reassuring voice on the other end confirmed her payments and then worked a sinister twist into the tale. A refund was due, but more than money was at stake; they sought her trust, her identity, and ultimately, her savings.

The heist was sophisticated yet simple: a URL, a fake PEA official on one end, a credulous yet wary retiree on the other. First, it was a plea for proof of payment, later a bizarre request for a face scan, all under the guise of a refund procedure. Kanlayaphat’s initial skepticism slowly gave way to assurance as the charlatan spun a web tight enough to feel real. The outcome? Four withdrawals that siphoned away life savings in increments of 279,097 baht, 799,148 baht, 630,516 baht, and 91,000 baht—a grand total she might never see again.

Fractured trust and unmet justice linger as Kanlayaphat pleads with the authorities at Huay Pong Police Station. Tired of the back-and-forth, her hope dwindles with the lack of updates. She is bounced between local police and the Cyber Crime Investigation Bureau (CCIB), each new lead a road filled with more waiting people. Her patience, like her funds, is nearly exhausted.

The system’s response? It leaves much to be desired. “It’s not for the likes of us ordinary folks,” suggests Kanlayaphat, implying a grim reality—unless your name lights up headlines, bureaucracy may bury your case beneath piles of others. As forceful as her cries might be, they compete with the cacophony of more glamorous scenarios vying for attention.

But Kanlayaphat is not just waiting idly. She questions and criticizes, raising concerns about the bank that promised security, only for the illusion of safety to shatter before her eyes. With emerging legal reforms, talk of greater accountability surfaces, placing banks and mobile service providers under scrutiny. Yet, this proposed act is still embryonic, with its maturation horizon yet to inked by authority.

Her story, though tragic, urges awareness—a clarion call in an increasingly digital world where anonymity emboldens deceit. As her case meanders through red tape, it’s a poignant reminder to maintain vigilance as impostors hone their craft, awaiting the next Kanlayaphat. Here in Rayong and beyond, the fight for justice persists, as does the hope that one day it won’t take fame for one’s pleas to be heard.

In this world of smoke and mirrors, Kanlayaphat’s story isn’t just about loss; it’s a testament to resilience, drawing attention to systems in need of reform while reminding us all to keep asking questions, demand assistance, and hold fast to accountability, no matter who—or what—stands in the way.

This is heartbreaking. How can we expect to trust anyone if scams are getting this sophisticated?

True, but people need to be more cautious. Clicking random links is never a good idea.

While I agree people should be cautious, we also must hold organizations accountable for their security advisories. Banks and services need to improve client education.

It’s easier said than done, Bill. Scammers are just adapting faster than people can protect themselves.

I’ve been in a similar situation, although I only lost a fraction of what she did. The authorities need to step up!

The problem is also systemic. We’ve put too much reliance on digital platforms without the appropriate protective measures in place.

Exactly my point, authorities have to make this a priority. People shouldn’t feel helpless after being scammed.

I’m seeing this more and more. Maybe it’s time for a consumer-led initiative to enforce better cyber standards.

That’s an interesting idea, but how would you propose we get something like that started?

We’d probably need a coalition, kind of like advocacy groups. Social media has a lot of potential for rallying support.

It’s a terrible situation, but some responsibility lies with Kanlayaphat too. At the end of the day, it’s her money to protect.

This case illustrates the dark side of technology adoption. Banks and law enforcement must catch up with these criminals.

Sadly, even then, it might not be enough with how swiftly scammers change tactics.

I think it’s about time the government intervened more directly in digital security. We’re living in a world where laws just can’t keep up.

Completely agree. Local and international laws should be ahead of tech advancements, not lagging behind.

There’s a lot of ignorance about digital literacy, especially among older citizens. Education can go a long way in prevention.

I prefer sticking to traditional banking methods. All of this online material is a scammer’s paradise.

Cases like these make me wary of online dealings. Yet, moving forward seems inevitable, doesn’t it?

Kanlayaphat’s experience is a painful reminder of what can go wrong. I hope her story prompts reform before more people suffer similar fates.

Stories like hers rarely move mountains but let’s keep our fingers crossed this one does.

One can only hope, right?

The incompetence of these bureaucracies is shocking. It’s like they’re set up to fail us.

It’s infuriating how little is being done. If only this much passion went into fighting climate change.

I sympathize with Kanlayaphat, yet this is a well-trodden path. Consumers should be proactive and vigilant.

Don’t these scams also reflect badly on government agencies? It’s appalling that such invitations to scams are not anticipated.