The financial landscape of Thailand is set for a high-stakes summit next week as the Finance Ministry and the Bank of Thailand (BoT) converge to discuss the robust baht and recalibrate the national inflation target. The government, led by Deputy Prime Minister and Finance Minister Pichai Chunhavajira, is making a concerted push towards interest rate cuts. Minister Chunhavajira has announced an upcoming meeting with BoT Governor Sethaput Suthiwartnarueput to tackle the thorny issues of the baht’s appreciation, inflation targets, and other critical financial matters.

According to informed observers, a potential interest rate cut is likely to dominate the discussions between the minister and the BoT governor. The government is keen to reevaluate the current 1-3% inflation target range that has been unchanged since 2020. This urgency arises from a persistent call for the central bank to mitigate the economic challenges by revising its interest rate strategy and potentially lowering the benchmark rate to inject vitality into the economy.

The call for monetary policy relaxation isn’t new. Former Prime Minister Srettha Thavisin had previously criticized the then 2.5% interest rate—the highest in a decade—lamenting its detrimental impact on the public and its potential to aggravate the national issue of high household debt. A review of the inflation target, coupled with a potential rate cut, seems to be gaining traction as a viable approach to reignite economic growth. The inflation rate in August stood at a modest 0.35% on an annualized basis, marking the fifth consecutive month of gradual increases, with projections estimating the full-year average inflation rate to hover around 0.8%.

Commerce Minister Pichai Naripthaphan voiced his reiteration yesterday for the BoT to slash interest rates, emphasizing that the central bank needs to be an ally in the government’s efforts to tackle the country’s economic problems. “Now is the time to cut interest rates. Even though the central bank insists on independence in its decision-making, it must now give a helping hand in tackling economic problems,” he remarked.

Prime Minister Paetongtarn Shinawatra shared similar sentiments, emphasizing the need for the government and BoT to reconcile their differences regarding rate cuts. “We have to sit down for talks. Otherwise, the issue will affect the people,” she cautioned.

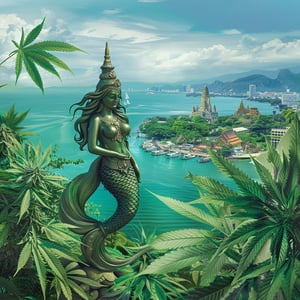

The private sector also echoed similar concerns. The Thai Chamber of Commerce (TCC) and the Board of Trade of Thailand, along with various private sector groups, have previously implored the BoT’s Monetary Policy Committee (MPC) to consider reducing rates to counteract the rapid appreciation of the baht against the dollar. Poj Aramwattananon, Vice-Chairman of the TCC, pointed out that the baht has surged by 8-10% over the last three months, a spike that makes Thai goods and services appear pricier on the global stage. This appreciation could dampen tourists’ spending, particularly impacting crucial sectors like shopping and accommodation, while also inflating production costs for Thai businesses.

The Kasikorn Research Center reveals alarming insights, indicating that if the baht appreciates by approximately 1% annually, it might slash exporters’ earnings by nearly 100 billion baht each year, translating to a 0.5% dip in GDP. This appreciation is largely attributed to the dollar’s depreciation, following a significant 50 basis point cut by the US Federal Reserve last week aimed at curbing inflation.

Despite the aforementioned concerns and a major rate reduction by the US Fed, the MPC is anticipated to stick to the existing 2.5% policy rate in its meeting slated for October 16, suggests Krungthai Global Markets, the research division under Bank of Ayudhya (Krungsri).

In a parallel development, the Thai cabinet has green-lit a substantial budget allocation exceeding 23.17 billion baht. This funding is earmarked for the second and third phases of a three-year debt moratorium aimed at aiding farmers burdened with loans from the Bank for Agriculture and Agricultural Cooperatives. The second phase will span from October 1 this year until September 30 next year, while the third phase will cover from October 1 next year to September 30, 2026.

As the clock ticks down to the pivotal meeting, all eyes are on how these discussions will shape the economic trajectory of Thailand. With high stakes and diverse interests at play, the anticipated outcomes are poised to have far-reaching implications for the financial stability and growth prospects of the nation.

Cutting interest rates is a good move to boost the economy, but won’t that just lead to more inflation in the long run?

Maybe, but shouldn’t we worry about the current crisis first? High interest rates are killing businesses.

People keep talking about businesses, but what about household debt? Lower rates could help families too.

I agree families need help, but we can’t ignore potential long-term effects. Inflation could harm them even more.

Why blame the central bank? They should remain independent. Government interference never turns out well.

True, but desperate times call for desperate measures. It’s not about blaming, it’s about collaboration.

Collaboration is fine, but not at the cost of central bank independence.

The central bank can’t be in an ivory tower. They need to be realistic about economic needs.

High interest rates might have worked in the past, but the economy is different now. We need new solutions.

This will only hurt exporters more. The baht is already too strong.

Totally agree. Exporters can’t compete with such a high-valued baht. Domestic jobs are at risk!

But a strong baht also shows a stable economy. There’s a trade-off.

Why isn’t more being done to stabilize the dollar? That’s a huge part of the problem.

Agreed, but we can’t control US policies. We can only adapt to their consequences.

Debt moratoriums are just delaying the inevitable. We need more sustainable solutions.

True, but it’s a relief for those currently in debt. Immediate help is also important.

Immediate help is good, but what’s the long-term plan? We can’t keep delaying.

Focusing on the long-term while ignoring present suffering isn’t right either.

Inflation is still below 1%. Do we really need to worry about it right now?

Yes, because once it starts rising, it can escalate quickly. Better to be cautious.

But isn’t caution slowing us down? We need action, not fear.

What’s really needed is a balanced approach. Both government and BoT should compromise.

Slashing interest rates won’t solve all problems but it’s a step in the right direction.

Private sectors requesting rate cuts are just looking out for their profits. Public welfare should be prioritized.

It’s a tough call for BoT. Whatever they decide, it will have major ramifications.

Indeed, which is why there’s so much debate about it.

Don’t forget, stronger baht can be good for imports too. Cheaper goods for consumers.

That’s a good point. But it shouldn’t be at the expense of local businesses.

True, finding a balance is key. Hopefully, the upcoming meeting yields some good compromises.

Can’t wait to see what the Finance Ministry and BoT decide. The stakes are high for everyone.