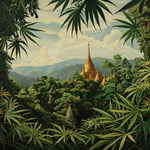

If you’ve ever wondered what the buzz is all about with the Paetongtarn Shinawatra administration’s policies, wonder no more! Last Friday, amidst the lush and waterlogged landscape of Chiang Rai, Prime Minister Paetongtarn Shinawatra was spotted, boots deep in mud, visiting flood-affected areas with a resolve as firm as her policy promises.

Paetongtarn Shinawatra’s government, fresh out of the starting blocks, presented their policy statement to parliament last Thursday, outlining a cornucopia of initiatives aimed at improving the economic well-being of Thais and boosting state revenue. Economists and political pundits are cautiously optimistic but emphasize that the proof of the pudding will be in the eating!

The policy kaleidoscope includes comprehensive debt restructuring focusing on home and car loans, providing a lifeline to those struggling with informal debts. For the long-term vision, there’s talk of dazzling entertainment complexes, complete with casinos, and a water management project designed to quench the persistent pest of flooding and drought.

Economic Relief: A Panacea or Pipe Dream?

Nonarit Bisonyabut, a senior research fellow at the Thailand Development Research Institute (TDRI), provided an analytical nod to the policy statement. Yet, even the finest landscapes have their rough patches. Nonarit pointed out that roughly 20-30% of key details seemed lost in the policy fog. “Remember, this is merely a policy announcement—a blueprint, if you will. Whether these lofty ideas touch the ground economically is yet to be seen,” he remarked wisely.

Household debt in Thailand is sky-high, making debt restructuring a necessary policy. However, key conundrums remain: How to effectively implement these policies? Previous initiatives—debt suspension, negotiations—have unfortunately landed with limited fanfare. The challenge is to conjure solutions that don’t defer this financial albatross to future generations.

One golden gleam in the policy treasure chest is the adjustment of the 10,000-baht digital wallet scheme. Originally devised as a digital lifesaver, it now involves handing out actual cash to a swath of 14.5 million vulnerable individuals. Economists believe this tangible touch will hit the needy right where it counts—in their pockets.

Moolah Megaprojects and Rolling Risks

Thanaporn Sriyakul from the Political and Public Policy Analysis Institute dissected the government’s economic priority focus, emphasizing the livelihood-centric approach. For instance, the 10,000-baht handouts set to roll out imminently capture the urgency of easing debt in less than a fortnight.

Turning to megaprojects, the narrative grows complex and colorful. The prospect of legalizing underground economic activities through casino-entertainment complexes is both exhilarating and treacherous. “It’s an appealing concept with potential economic benefits, but equally laden with social pitfalls,” Nonarit cautioned.

Numerous bold projects, the proverbial feathers in the government’s cap, flutter about, raising eyebrows and anticipation. Take the Land Bridge and the audacious plan to create artificial islands as a hymn to rising sea levels. Such ventures awaken memories of Thaksin Shinawatra’s grand, often controversial, schemes. These proposals bear a heavy burden—potential corruption and financial misfeasance lurk as real dangers.

Debt: An Everlasting Quagmire

As Chaiwat Sathawornwichit from the opposition People’s Party highlighted, the immediate priority must be tackling household debt. Families reeling under financial stress often gravitate toward non-formal loans as a desperate measure.

The previous Srettha Thavisin administration faltered despite elevating debt resolution to a national agenda item. Chaiwat advocates for inventive solutions, perhaps whispers of reducing interest rates or loan obligations to untangle the nation’s debt-ridden mess.

Foreign Policy, Scams, and Strategic Postures

On the international front, criticism rings louder—Thailand’s foreign policy deemed weak. Chaiwat urged a stronger strategic positioning for a nation poised as the ASEAN’s second largest economy. Additionally, the soaring incidents of call-center scams present a curious opportunity—strengthening international cooperation against this modern menace.

Focus, Vision, and Governance Risks

Amidst the legislative labyrinth, Mr. Thanaporn identified a protracted and nebulous path towards constitutional amendments. As political winds shift, particularly towards the Bhumjaithai Party, the governmental risks remain surprisingly low. Even amidst internal political reshuffling, the ruling coalition appears robust.

Yet, concerns linger. Chaiwat highlighted the government’s “family cabinet” image, creating a hazy chain of command and policy continuity worries. With multiple coalition partners, governance stability rests precariously on the delicate balance of shared and divided interests.

Really? Just handing out cash to people? Sounds like a recipe for inflation.

It could help those in immediate need, though. Better than doing nothing.

Immediate relief is great, but long-term solutions are needed.

Exactly. We need sustainable solutions, not just quick fixes.

Debt restructuring is a band-aid. We need major economic reforms.

But isn’t restructuring better than ignoring the problem?

Reforms take time, and people are suffering now. Debt restructuring can help in the short term.

Legalizing casinos? That’s just asking for social issues to skyrocket.

But it could bring in a lot of revenue. Every coin has two sides.

I agree with Sophia. The negative social impact could outweigh the benefits.

The PM is actually going to flooded areas? Feels like a publicity stunt.

At least she’s doing something. Better than sitting in an office all day.

Just showing up doesn’t solve anything. Actions speak louder than words.

True, but politicians are experts in showing face without real change.

Artificial islands? Are they trying to copy Dubai?

It’s ambitious, but the environmental impact worries me.

Whoa, let’s see if they can actually pull this off before comparing to Dubai.

Agree, it’s a huge leap. Let’s hope it doesn’t end up as another failed project.

Focus on combating scams sounds good, but where’s the execution plan?

Exactly. Talking about it and doing it are different things.

Scams are an international issue. Thailand can’t solve it alone.

Debt problems are inherited issues from previous governments. Give Paetongtarn some slack.

Digital wallet to actual cash is better. More accessible for everyone, especially the older generations.

Nonarit is right, 20-30% detail loss could spell disaster. Details matter!

Absolutely. Policies are nothing without proper details and implementation.

But expecting everything to be perfect right away is unrealistic.

Megaprojects always end up being money pits. Can’t trust them.

True, but with proper management, they could also be game-changers.

Proper management is a rare commodity in politics.

Tackling household debts should be priority number one. Everything else comes second.

Without reducing household debt, people can never get ahead.

Chiang Rai has been suffering for years. About time someone took it seriously.

Foreign policy critique is spot on. Thailand needs to step up on the global stage.

Does anyone really think this government will be different from the previous ones?

Every government promises change, but few deliver.

Concerned about the ‘family cabinet’ image. Could lead to nepotism and lack of accountability.

Nepotism is a poison to any administration. Transparency is key.

Chiang Rai flood crisis calls for immediate action, but it needs more than just visits. Invest in infrastructure!

Water management project is a long overdue. Climate change is real, and we need measures in place.

Hope it’s more successful than past water management efforts.