In a riveting tale of cat-and-mouse that resembled a Hollywood heist film, the Revenue Department and the Central Investigation Bureau (CIB) have unravelled what appears to be one of the most elaborate VAT fraud networks ever seen in Thailand. Last week, synchronized police raids unfolded across 14 different locations in the scenic provinces of Tak, Chiang Mai, and Bangkok. On the radar was Samran Naowarat, a wily 63-year-old mastermind, and his nine associates, all allegedly orchestrators of the grand scheme. The operation came to fruition under the watchful eye of Police Major General Thatphum Jaruprat of the Economic Crime Division (ECD), who announced that a tip-off from the Revenue Department regarding Samran’s shadowy dealings at S&M Brotherhood General Trading Co Ltd had set the wheels of justice in motion.

With the deftness of an illusionist, Samran had artfully registered no less than 20 VAT-registered businesses under the guises of family, friends, and perhaps his most loyal employees. These companies did not exactly pull any rabbits from hats, but what they did was conjure fictitious transactions. Imagine invoices where goods seemingly appear out of thin air, puffed up with inflated values and a darling 7% VAT—all without any actual exchanges of goods. What a trick, eh?

S&M Brotherhood became the proud paper trail acrobat, pretending to purchase these costly goods only on paper for exports to Myanmar. They deftly danced around taxes using sham export documents to claim those luscious VAT refunds. Since these illusory consumer products were exempt from export duties and VAT, the clever crew could pocket significant refunds based on ballooned purchase tax amounts. A tactical loophole, to say the least.

Pol. Maj. Gen. Thatphum shed light on how the fraudsters exploited the system repeatedly by faking sales in a seemingly never-ending cycle of deception. Between 2021 and 2022 alone, the audacious network pocketed a staggering 150 million baht in VAT refunds, with the total heist running over a whopping 1 billion baht. During the blitz of raids, officers seized towers of over 100,000 documents, a treasure trove of 20 mobile phones, and 30 computers, all believed to hold the secrets of this grand fraud.

The law isn’t likely to be kind, and the charges are weighty: from illegal issuance of tax invoices to attempted VAT evasion, using forged invoices for tax credits, and filing false claims. The stage is set for a pressing courtroom drama. The entire escapade, some might say, is ripped right out of an international thriller—a reminder of the perils and plays behind tax evasion.

Authorities warn businesses to steer clear of such underhand practices, urging the public to tip them off to any suspicious VAT refund activities. The investigation continues deep into the shadows, as officials probe for potential accomplices or even other companies tangled in this web of deceit. The saga has turned the city’s newsrooms into hives abuzz with updates and speculation about the broad implications of this crafty criminal escapade.

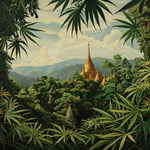

All the while, the backdrop is a compelling series of unfolding news—perhaps symbolizing the storm of change sweeping across Thailand. From capsized police boats to striking cannabis-related reforms, or battles against nature’s fury in unexpected flash floods—Thailand is nothing short of a kaleidoscope of modern drama.

Who knew a taxation scandal could spin a tale so engrossing? As the narrative unfurls, only time will tell how this orgy of fiscal trickery and epic investigations will end. A little too much excitement for your average tax collector, no? But rest assured, there’s always some light amidst dark financial theatrics, as the wheels of law grind towards justice.

The biggest scandal is not the fraud itself, but the loopholes in the system that allow it. Our tax codes need to be airtight!

That’s easier said than done. Tax evasion isn’t just about loopholes—it’s about people exploiting every little angle.

True, but if the system wasn’t so fragile, there wouldn’t be as many angles to exploit.

But how can we ever fully close all loopholes without harming honest businesses?

Samran and his crew should get life sentences. The scale of this theft is outrageous!

It’s a huge crime, sure, but life sentences? That’s extreme. White-collar criminals rarely face such severe punishment.

We need harsher penalties to deter others from attempting similar scams. Otherwise they think it’s worth the risk.

When you consider how many resources were lost, I think it’s just. Think of the public services that money could’ve funded.

Someone needs to address the accountability from the authorities’ side. They’ve been sleeping on the wheel for too long.

Yes, if our systems were properly monitored, this scheme wouldn’t have gone on for so long without detection.

Agreed, maybe this will push for better technology and systems in monitoring tax claims in the future.

If the government spent as much effort on catching scammers as they did on petty budgets, we might see real change.

It’s all about priorities. Chase the big fish and the small fry will either fall in line or get caught quicker.

Exactly. Focus on high-value fraud. We can’t fixate on pennies when dollars are slipping away.

This entire episode is a testament to human greed and ingenuity. Kind of impressive, in a twisted way.

Shows how reality is stranger than fiction. Truly a plot worthy of a crime thriller.

A perfect case study for business ethics classes. The consequences of financial deceit on display.

Does anyone know what happens now to the employees involved in these scams?

Probably facing prison time and massive fines. They knew what they were getting into, right?

True, but I wonder if they were coerced or simply blind followers?

Many of them might’ve been loyal to Samran, thinking they’d never get caught.

In the midst of all this drama, it’s a reminder to invest in systems. Prevention is better than cure.

I heard about it from someone working internally about minor warnings in past audits. This could have been avoided.

Tax evasion is a global issue. Thailand’s case is big, but there are similar stories worldwide.

True, tax systems can often be too complex for their own good globally. SA isn’t a world away in governance issues.

While Samran’s crew dances their paper tricks, honest workers struggle to earn an honest living. Irony is palpable.

I think people obsessed with ‘jail time’ need to realize fixing societal problems is harder than punitive measures.