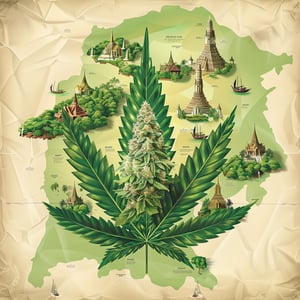

Imagine gallivanting between the eclectic street markets of Hong Kong and the golden temples of Thailand with nothing but your smartphone in hand to pay for all your whims and necessities. This technicolor dream is now a resplendent reality as the convergence of the Hong Kong FPS x PromptPay link takes the stage and promises to revolutionize cross-border QR payments. The Bank of Thailand (BOT) and the Hong Kong Monetary Authority (HKMA) have synchronized their symphony into a joint press release, and it’s music to the ears of travelers and traders alike.

Armed with just a mobile payment application, visitors can now whisk through transactions with the simplicity of scanning a QR code – be it under the neon glow of Hong Kong or amidst the spicy aroma of Thai street food. This QR pas de deux between the Hong Kong FPS QR code and Thai PromptPay QR code is a dance of convenience that ensures each payment pirouettes directly into merchants’ coffers, posthaste and with secure grace.

But what’s a good show without an ensemble cast? The characters in our play are none other than the customers and merchants, both reaping the rewards of this efficient payment method. The former enjoys a seamless transition from sightseeing to shopping, whilst the latter revels in the instant gratification of accelerated funds.

Let’s not forget the grand backdrop against which this story unfolds: the tourism and economic landscape of Hong Kong and Thailand. The new payment system is the wind beneath their sails, promising smoother commerce and increasingly happy tales of cross-border camaraderie. Guests of the service can engross themselves in transactions up to a riveting 100,000 baht in a single payment and up to an exhilarating 500,000 baht per day. And, lo and behold, our fable’s twist: there are zero fees.

Amidst this joyous occasion, two maestros – Bank of Thailand Governor Sethaput Suthiwartnarueput and HKMA Chief Executive Eddie Yue – stepped onto the podium to laud what they described as a milestone of milestones. Governor Sethaput waxed lyrical about Thailand’s leap into the digital age, while Chief Executive Yue highlighted the expanding reign of FPS in the kingdom of cross-border payments.

Their heralded union has given birth to an ecosystem where transactions are swifter than a dragon boat race on Victoria Harbour. The service is supported by an infrastructure of digital titans—the instant payment systems of Hong Kong Operated by Hong Kong Interbank Clearing Ltd (HKICL) and Thailand’s National ITMX. Banks like the mighty HSBC Hong Kong and the venerable Bangkok Bank serve as the steadfast settlement banks, overseers of the mobile payment realm.

The participating fellowship includes seven prodigious banks and two Stored Value Facilities in Hong Kong, and a triumvirate of commercial banks from the lush lands of Thailand. All harmonize in rendering the service as seamless as the Chao Phraya River’s flow.

As both central banks have professed, this innovative leap into the realm of cross-border QR payments is a beacon of efficiency, security, and affordability. It is a stepping stone to future fintech collaborations, a ripe field where seeds of economic growth wait to sprout under the warm sun of technological advancement. This is no mere evolution in retail payment; it’s a revolution—a joyous parade through the boulevards of commerce where all are invited to partake in the spectacular festivities of the digital age.

Be First to Comment