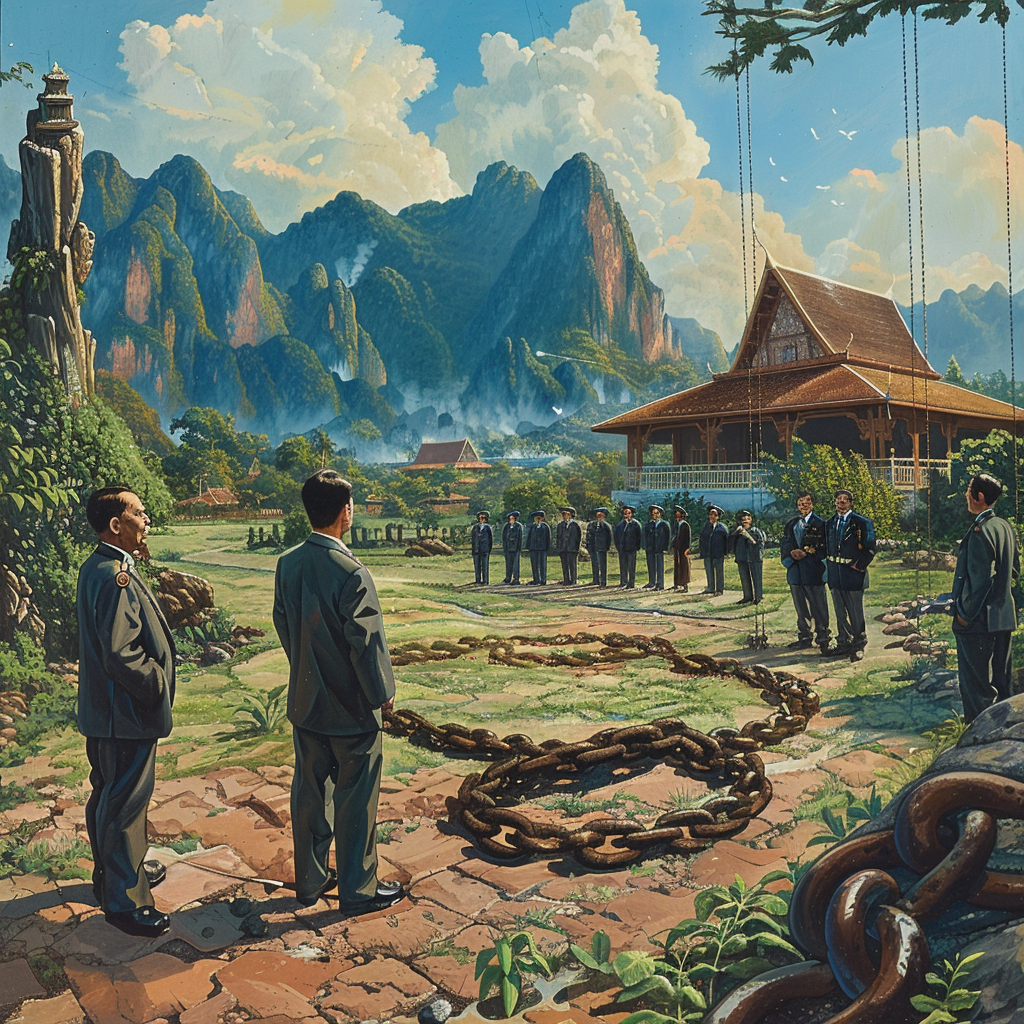

Imagine a scene right out of a high-powered political drama: former Prime Minister Thaksin Shinawatra, charismatic and wily, shares a table with the man currently at the helm, Prime Minister Srettha Thavisin, and then there’s former Prime Minister Somchai Wongsawat, who not only shares a political lineage but is also Thaksin’s brother-in-law. They were spotted dining at the serene Ban Green Valley in Mae Rim district, Chiang Mai, a setting so picturesque it could easily be mistaken for a film set. But make no mistake, this was no scripted event — this was Thai politics in its full, vibrant earnest.

Prime Minister Srettha Thavisin, stepping into the spotlight, recently made a bold pledge that caught the attention of nearly three million civil servants. He vowed to tackle the Goliath of debts overshadowing these public sector workers, with a plan as audacious as it is critical — lowering interest rates to lighten their burdens. The stage for this was set after a crucial meeting with the chiefs of 11 state agencies, where they reviewed the progress made in the past two months to combat this financial hydra.

With the steadfastness of a seasoned leader, Mr. Srettha emphasized the urgent need to continue these relief efforts. He painted a stark picture, one where ignoring the ballooning debt could spiral into a national catastrophe. Calls were made, pleas were heard, asking financial institutions to reconsider, to lower their interest rates and offer a lifeline to those drowning in debt. Yet, the Bank of Thailand stood unyielding, like an immovable object facing an unstoppable force.

In a move that underscored his commitment, Mr. Srettha announced plans to bring the Cooperative Promotion Department (CPD) into the fold of the government’s debt solution program. The stakes? High, as a significant number of civil servants and state employees find themselves ensnared in debts to their organizations’ cooperatives.

The plight of these employees took center stage when Pol Gen Kittirat Phanphet, the deputy police chief doubling as the deputy chair of the government committee on people’s debts, shared some startling numbers. Of the 3.1 million civil servants, about 2.8 million are submerged in over 3 trillion baht of debt. Despite their efforts to keep afloat, many find themselves barely scraping by after their monthly debt service.

And then, there’s the matter of the Student Loan Fund (SLF). In an audacious move, Prime Minister Srettha is set to negotiate potentially lower interest rates for those defaulters facing a staggering 18% interest p.a. It’s moves like these that could change the game for many.

In the face of a rising tide of non-performing debts, a clarion call has been made to revise relevant laws — a call that suggests a path forward may lie in restructuring and settling debts in a manner that offers a glimmer of hope.

In a show of solidarity, Defence permanent secretary Gen Sanitchanok Sangkhachan disclosed the ministry’s strategy to assist its financially encumbered personnel. It’s a testament to a collective effort, across various sectors, signaling a beacon of hope in what has seemed an insurmountable struggle.

This tableau of political unity, of promises and plans, of battles fought in the corridors of power and in the ledgers of banks, paints a vivid picture of Thailand’s resolve to tackle a crisis that threatens the very fabric of its society. Only time will tell if these concerted efforts will turn the tide, bringing relief to those who serve the nation. But one thing’s for certain — in the realm of Thai politics and economics, the drama never ceases, and the stakes are always high.

This plan sounds good in theory, but how will it actually be implemented? Lowering interest rates for millions without causing inflation or putting too much pressure on banks seems like a miracle waiting to fail.

That’s a simplistic view. The government likely has monetary tools and policies to manage inflation. Plus, helping civil servants manage their debt could improve economic stability in the long run.

Economic stability is crucial, I agree. But past attempts at debt relief have shown mixed results. Without addressing the systemic issues that lead to this debt, we’re just putting a band-aid on a bullet wound.

It’s interesting how quickly people forget that the banks and financial institutions are part of this problem. They’ve been happily compounding interest on civil servant’s loans for years. Lowering interest rates is the least they could do.

Banks are businesses, not charities. Expecting them to just lower interest rates without any governmental incentives or compensations is unrealistic and ignores the complexities of the financial system.

Finally, a leader who cares! PM Srettha’s commitment to easing the financial burden on civil servants is a breath of fresh air. We’ve been waiting for someone to take a stand against the crippling debt issue.

Caring is one thing, executing is another. Promises are easy to make and hard to keep, especially when it comes to financial matters. Let’s see if there are real changes or if it’s just another political stunt.

Skeptical but hopeful. I understand the caution but choosing to be optimistic. The plight of civil servants has been ignored for too long. It’s time for change, and every journey begins with a single step.

While assisting civil servants is urgent, I’m more concerned about the broader economic implications. We are addressing the symptoms, not the disease. What about the lack of financial literacy, the culture of debt, and the structural issues in our economy?

Absolutely spot on. Without tackling the root causes, we’re doomed to be in a continuous cycle of debt relief and financial crises. It’s like fixing a leaking pipe by turning the water off instead of repairing the pipe itself.

What about the social implications? This heavy debt among civil servants must be incredibly stressful, leading to other societal issues like depression and family problems. Financial policies should also consider the mental health and wellbeing of the population.

That’s a really good point, Eduardo. The mental toll of debt is huge, and tackling this issue can have significant positive impacts on society as a whole. It’s about time our leaders started seeing the bigger picture.

It’s the same old song and dance with these politicians. Big promises, high hopes, but little to no action. Been hearing about ‘debt solutions’ for years, yet here we are, still discussing the same problems.

Change takes time, especially with issues as complex as national debt and financial reform. While I understand the frustration, I think it’s unfair to dismiss efforts before they’ve had a chance to materialize. Let’s give PM Srettha a chance to prove himself.

Fair point, Olly. Maybe I’m just cynical from past disappointments. But you’re right, change does take time. Here’s hoping Srettha’s plan is the start of that change.