As the world gears up to embrace the holiday festivities, Platinum Fruits Public Company Limited (PTF) is stirring up excitement of a different kind, preparing to sprinkle its magic on the stock market. With a bold step forward, PTF filed their intentions with the SEC on December 20, 2024, aiming to etch their presence under the ticker symbol PTF. What’s the game plan, you ask? Nothing less than a grand entrance, offering 200 million IPO shares to amplify their export endeavors. It’s like PTF’s holiday gift to the world!

Behind this strategic venture is UOB Kay Hian (Thailand) Public Company Limited, taking up the role of financial adviser. The stakes are high, especially with PTF basking in the glory of reported revenues exceeding 5.7 billion baht within the first nine months. And now, eyes are set on a new horizon—exporting the luxurious sweetness of longans to India.

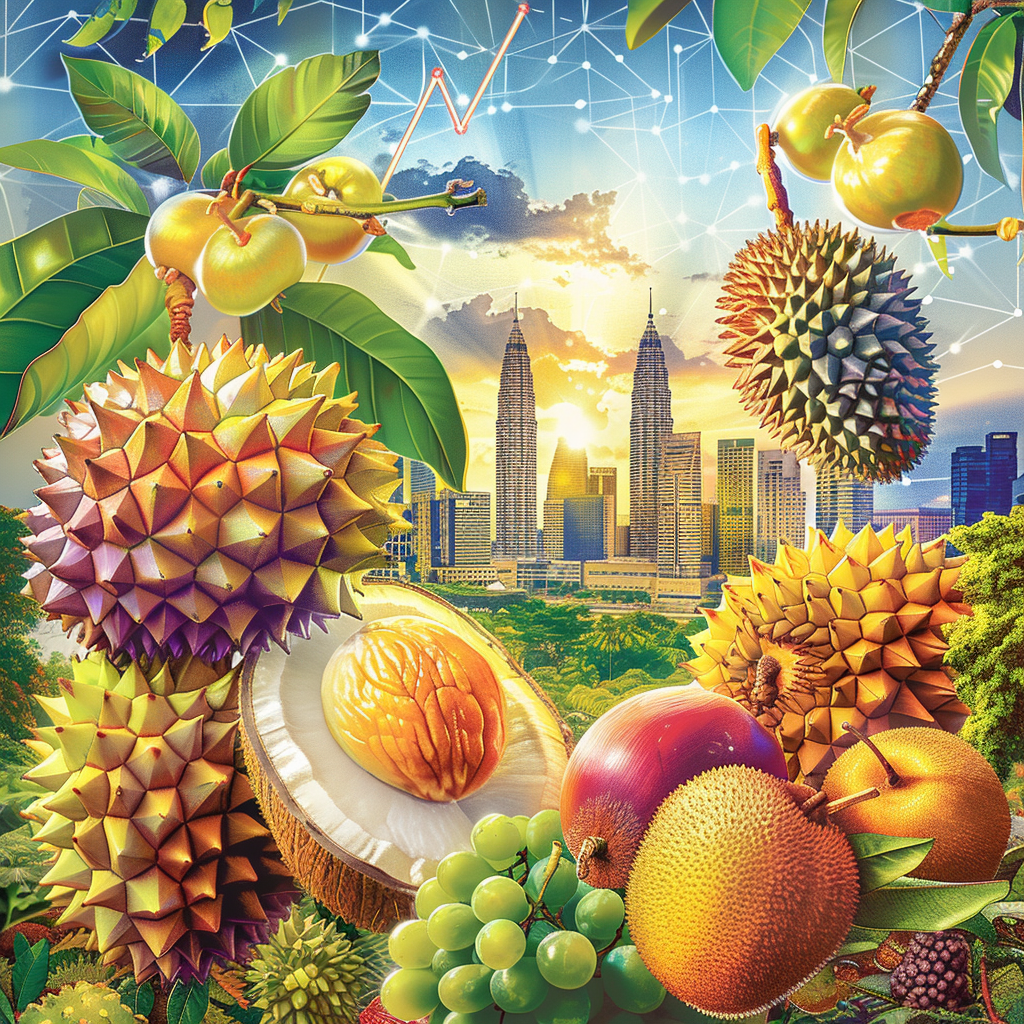

As the driving force behind this vision, Mr. Theerasak Taweepiyamaporn, the astute Managing Director of Corporate Finance at UOB Kay Hian Securities (Thailand), brings his seasoned expertise to the table. The PTF, renowned for its devotion to exporting premium fresh fruits and vegetables, currently charms nine East Asian countries and special regions with its irresistible array of durian, longan, mangosteen, and coconut.

The big reveal sets the stage for PTF’s arrival onto the market—a dazzling IPO consisting of 200 million shares, a generous slice making up 25% of the company’s freshly baked pie of ordinary shares post-IPO. Once the dust settles, Platinum Fruits will flaunt a registered capital of 400 million baht, a leap from the current 300 million baht. Imagine a treasure chest filled with 800 million glittering shares, each shining with a par value of 0.5 baht.

Championing this verdant voyage is Chief Executive Officer, Mr. Natakrit Eamskul, with a compelling vision: “Growing Together Fruitfully.” It’s not just about business; it’s a philosophical journey. The company wears its actor’s robes with flair, orchestrating the entire spectrum from sourcing top-notch agricultural wonders from orchards reverently certified with GAP and Global GAP standards to deciphering and fulfilling the appetites of an ever-diverse world market.

PTF isn’t merely about the glamour of fresh fruit—they’ve invested in a state-of-the-art One-Stop Service logistics system, ensuring their fruity treasures traverse continents, gracing Asia and Europe, including China, Indonesia, India, Taiwan, Hong Kong, New Zealand, and the United Kingdom. And it doesn’t stop there; educating Thai farmers to elevate fruit quality meets the desires of global markets, allowing PTF to deliver year-round harvest joy.

In this intricate dance with nature, PTF remains steadfastly committed to environmental stewardship and championing the livelihoods of local communities. It’s about sustainable prosperity, a harmonious duet with nature, and thriving in unison with all stakeholders involved.

Dotted around the ecosystem of Platinum Fruits are four dynamic subsidiaries:

- 888 Fruits & Vegetables Co., Ltd. (TFV): Dedicating its efforts to exporting garden-fresh fruits and veggies.

- 888 Logistic Co., Ltd. (TPL): Mastering the art of container ballet, transporting goods near and far.

- Sky Shore Trading Co., Ltd. (SST): A maestro offering comprehensive container services, from customs acumen to ship charters at the bustling Laem Chabang port.

- Sky Shore Depot Co., Ltd. (SCD): The land steward, offering space for container storerooms.

Cast your gaze back to the PTF’s impressive journey through the fiscal trails of 2021 to 2023, amassing revenues of 3,613.06 million baht, scaling to 5,345.51 million baht, and further to 5,489.40 million baht. Fast forward to the first three quarters of 2024, and the narrative continues with revenues leaping to 5,797.60 million baht, marking a robust upturn of 21.17%, a cool addition of 1,012.89 million baht over the same stretch last year considering the net profit soared by a luscious 153.98 million to a striking 247.61 million baht.

Behind this lucrative crescendo is a meticulously crafted plan, one that has flung open the gates to new markets. Recently, the plan sprouted another success story—the flourishing debut of premium-grade longan exports to India.

In tandem with this success story, PTF upholds a generous dividend policy, promising not less than 40% of net profit in dividends to investors, a delightful after-tax treat in keeping with laws and wise practices. A sweet incentive for those who choose to embark on the PTF journey!

Honestly, I think this IPO is a brilliant move for Platinum Fruits. However, the competition in exporting fruits to India is stiff. Will they actually manage to stand out?

I agree, the Indian market is quite saturated with local options. They’ve got the logistics covered, but let’s see if their marketing can make their produce irresistible.

It’s true, but their push on quality standards could be a game changer. If they can maintain those, they might just carve out a niche.

Isn’t this just another case of a company trying to do too much at once? They might overextend themselves.

I’m concerned about the environmental impact of all this shipping. Are they really committed to sustainability, or is it just corporate fluff?

Their logistics certainly sound impressive, but I share your concern—too many companies greenwash their intentions without real action.

According to the article, they are providing education on sustainable practices to local farmers. At least that’s a step in the right direction.

With that kind of revenue growth, I’m putting my money in their stock for sure. The dividend policy is a cherry on top!

Sure, it looks promising on paper. But things can change once they go public. I’d stay cautious and keep an eye on market stability.

How does this affect local farmers like me? Are big companies like PTF going to undercut our prices and market share?

I think PTF is more focused on export markets. Your local market might not feel the same impact, especially if you’re not exporting.

That’s true, but global demand affects local prices too. Let’s hope they actually support local agriculture as they claim.

The focus on exporting to high-demand markets like India and China is smart. They’re capitalizing on growing economies and potential trade synergies.

I’m curious if PTF has a plan in place to tackle potential trade barriers and tariffs in these new markets. Wouldn’t that affect their profits?

Trade barriers are always a risk in international business, but experienced firms usually have strategies to mitigate those risks. Let’s hope PTF has done their homework.

With someone like Mr. Taweepiyamaporn leading the charge, I’m confident in their management. His experience should help them navigate the stock market maze.

As long as they keep focusing on quality and sustainability, more power to them. It’s high time big companies lead by example in sustainable practices.

I think their ‘Growing Together Fruitfully’ slogan is just a marketing ploy. Companies talk big about community involvement but fail to deliver real benefits.

Sometimes these initiatives do start with good intentions. Only time will tell if they will actually follow through.

From an investment perspective, the numbers look solid, but I wonder if they’ve considered the volatility of the agricultural market.

Does anyone else think this IPO might be overpriced given the risks? 400 million baht is quite a leap from their current capital.

I find the idea of dividends enticing, but I’m not experienced with such stocks. Is it safe for beginners to jump into this?

IPO stocks can be volatile. If you are a beginner, it’s wise to diversify your investment and only use money you’re willing to risk.

Thanks for the advice. I’ll keep that in mind as I explore my options.

Excited to see how PTF adapts to consumer palate changes and competition. Going global means catering to various tastes.

Their commitment to elevating fruit quality is really the heart of their strategy. Let’s see if that translates to sustainable growth.