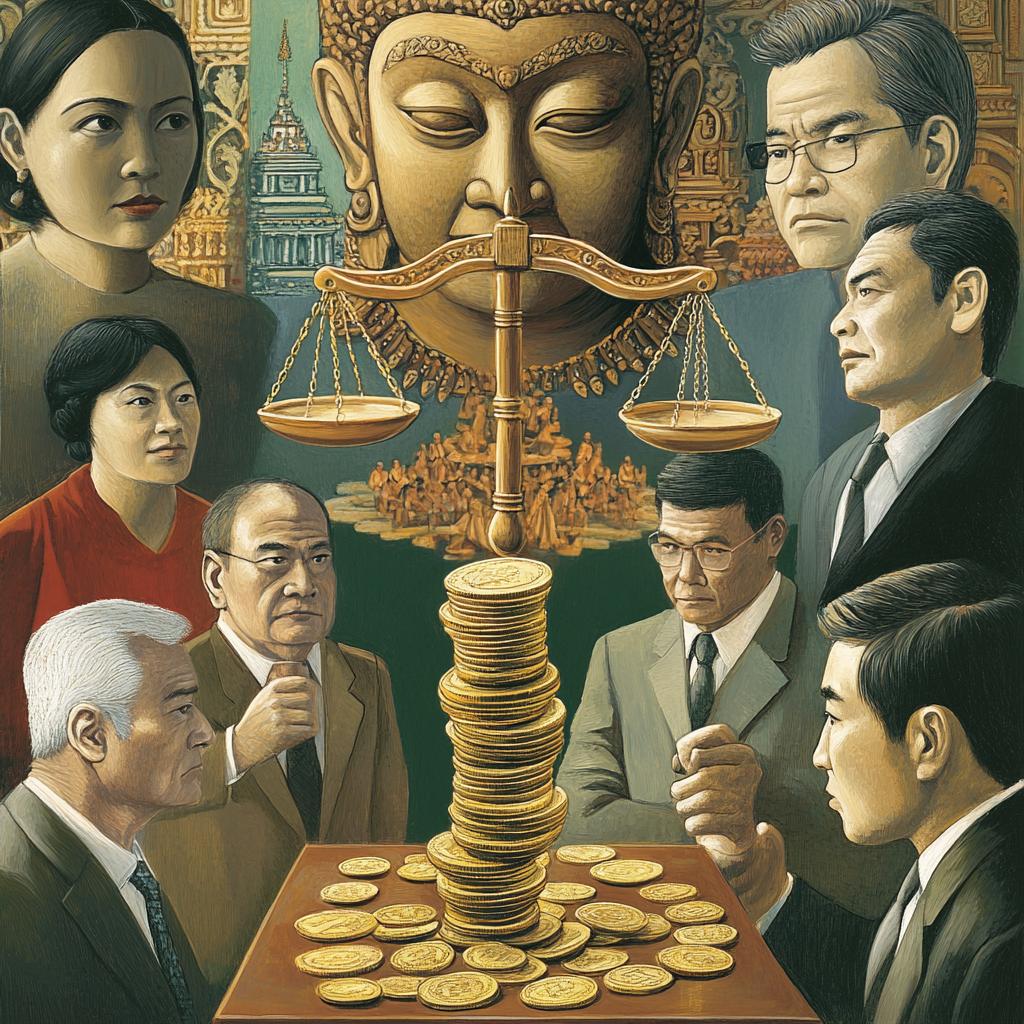

In a twist that could easily be plucked from a high-stakes drama, the Social Security Fund (SSF) Board has nixed a newly proposed pension formula. The verdict? Simply too convoluted to swallow! It’s akin to one of those seemingly great ideas that, when explained, leaves you scratching your head more than nodding in agreement.

Assoc Prof Sustarum Thammaboosadee, who moonlights as the coordinator for the Progressive Social Security Team, did not hide his disappointment following the recent panel pow-wow. In his post-meeting reflections, he expressed his sincere apologies for not persuading the board to embrace the innovative proposal. But fear not, like a hero undeterred by a setback, Sustarum promised to dust himself off and try again in March.

This drama unfolds with a significant stake for over 300,000 insured individuals under Section 39, who are the unsung actors in this unfolding play. Once gainfully employed, they’ve continued to contribute to the SSF by the sheer force of their will, i.e., paying their own insurance. The plan aims to recalibrate their pensions in tune with the serenades of inflation and the ebbs and flows of the cost of living.

Picture this: a salary basis that was pegged at 5,000 baht two decades ago is now reinvented and adjusted to today’s inflation rate realities. In essence, what may have been a humble starting point is poised to evolve with time’s progression. While it sounds harmonious, the reality is a tad more complex than a simple melody.

Sustarum, with candid foresight, avowed that despite the tweak, the SSF can absorb the increased financial demands — a testament to the fund’s solidity. We’re talking about footing a 60 billion baht bill over the next decade, a mere ripple compared to the current 2.6 trillion baht in the fund’s coffers. Not exactly your grandmother’s piggy bank!

The proposed method met sub-committee nods last October, welcoming it like an old friend during a cordial tea. Yet, its journey proved less straightforward when it faced the full compass of the SSF board’s scrutiny. Amidst the formal debates, Sustarum claimed that amidst all the numbers and formulas, the spirit of fairness remains untouched for those under Section 33 — thanks to supplementary contributions from both employer and employee alike.

In a conclusion that paints as much intrigue as an open-ended mystery novel, the grip was tight: the team was urged to give the formula another go-over — a classic rewrite before another possible act opens. Sustarum, with an inquisitive twist of the eyebrow, hinted that perhaps the board’s hesitation is rooted in their tenacious inquiry. No detective hats here, but something akin to a Sherlockian anticipation.

As he appealed passionately for public vigilance, the call was clear: keep an eye on future developments. How this gigantic juggernaut of 2.65 trillion baht which acts as a lifebuoy for 24 million citizens unfolds its crests, reflects on the need for transparency and accountability in handling people’s financial security. Indeed, the eyes of the nation are keenly watching, popcorn in hand, ready for however this tale might turn next.

Assoc. Prof. Sustarum’s pension reform sounds like a step towards increased fairness, especially with inflation adjustments. It’s a shame the proposal was rejected.

It’s complicated for sure, but the board’s decision might’ve been based on complexities they saw. Change has to be manageable.

Yeah, that’s true. It’s just frustrating to see a plan that could help so many get bogged down.

If it’s not easy to understand, maybe it’s not the best solution! Simplicity often wins.

I’m puzzled by why the board would reject a financially sound proposal. The fund is capable of absorbing costs, seeing it’s a minor ripple against 2.6 trillion baht.

Maybe they’re playing it safe. When you juggle billions, even small risks can induce caution.

True, but stagnation can be a risk too. We need innovation in social security!

All I see is a board sitting on their cash pile while future retirees suffer. Fight on, Sustarum!

We have to be patient. Policies need careful crafting, but agreed, transparency could help build trust.

I want a system that’s flexible and can adapt over time. Inflation is a reality; ignoring it is not smart policy.

It’s good that the SSF board is looking at fairness for Section 33. Still, how real is this fairness when other sections are left out?

Exactly, it’s about striking a balance. Fairness should be universal.

Yes, and social security is supposed to be for all insured. Why single out a group?

Why do I feel like this reform is just a scam? All about appearances and no real substance. Show me the numbers!

I’m wary. Postponed proposals sometimes lose steam. Sustarum must act fast if he wants results.

Timing is crucial. But bureaucracy doesn’t move quickly.

Thailand needs modern pension solutions. Sticking to old formulas makes no sense in today’s world.

Changing the system is part of progress, but no need to rush. Sound finances are crucial.

Exactly. We need strategy, not just speed.

Right, rushing could lead to even bigger problems down the road.

Glad the proposal was rejected. Last thing we need is changes that confuse everyone.

Understandable, but confusion can be addressed with clear communication.

I’m already retired. Changes to the system panic me. What if it affects my current pension?

The board might be conservative, but reforms backed by data and vetted through sub-committees should carry weight.

Stupid board! They’re paid off by big money interests. Wake up, people!

Blaming ‘big money’ is shortsighted. Sometimes decisions are plain context-driven, not corrupt.

Significant reform bills take multiple rounds to get right. Sustarum and team just have to stick with it. Persistence is key!