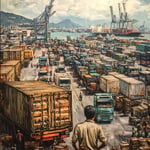

Containers are prepared for export at the Laem Chabang deep-sea port in Chon Buri province. (File photo: Nutthawat Wichieanbut)

The economy is currently at one of its bleakest points, but economic experts expect the situation to bottom out in the second half of the year now that the national budget has been rolled out. Things usually seem to be at their worst just before they get better, and the same can be said for the Thai economy, according to Nonarit Bisonyabut, an economist at the Thailand Development Research Institute (TDRI).

Mr. Nonarit said the country’s economy has entered a dark patch in the short term due to several factors, chief among them the sluggish disbursement of the national budget and high domestic and international interest rates that discourage investments.

Politics a potential drag

However, he said the situation will improve as global interest rates fall. The European Central Bank recently lowered interest rates, and the US is projected to make another cut this year.

“I’m calling it the ‘4am economy’ because we’ll see a ray of light soon. We’ve seen lower interest rates, with the US expected to make four cuts next year and Thailand likely to follow suit,” he said.

Mr. Nonarit said state spending started in May and will continue to roll out while the details of government projects become clearer. The export sector, meanwhile, is showing signs of improvement, and so is the global economy.

“That means we’ll be entering the dawn, and the economy is expected to start growing again,” he said.

However, the pace of the country’s economic growth depends greatly on its ability to meet global market demands and tackle the challenges brought by an aging society.

Moreover, the state of politics can also retard economic recovery, especially if Prime Minister Srettha Thavisin is removed from office, causing political disruptions.

The case against Mr. Srettha concerns the controversial appointment of politician Pichit Chuenban as a PM’s Office minister in the last cabinet reshuffle. It was initiated by a group of 40 senators who accused the prime minister and Pichit of breaching cabinet minister ethics.

They asked the court if the pair should be removed from office under Section 160 (4) and (5) of the constitution, which deals with the ethics of cabinet ministers.

They argued that Pichit was unfit to assume a cabinet post because he served time in jail for contempt of court following a bribery case in which he represented Thaksin Shinawatra in 2008.

“The economy also hinges on the political climate. If the country has to find a new prime minister, government policies will be further delayed,” Mr. Nonarit said.

Digital wallet the main priority

Asked if the Pheu Thai-led government’s policy over the past nine months can help stimulate the economy, the TDRI researcher said that apart from delays in the budget rollout, the government is focusing more on the digital wallet scheme than other small-scale economic measures.

“The government has to save money for the cash handout program, so there are no smaller programs to grease the wheels,” he said.

There remains a big question mark over foreign investments, he said. It is too early to tell if the prime minister’s overseas trips to lure foreign investments will bear fruit, although some major companies say they plan to relocate to Thailand.

“There are fundamental factors that will lure investments, such as human resources and skill sets. This is a main obstacle and it needs long-term planning to address this,” he said.

After the political uncertainty is gone and political stability is established, Mr. Nonarit said, the government should implement short-term measures and move to address economic reforms, especially building the workforce to support the market.

Weak exports, lower spending

Tanit Sorat, vice-chairman of the Employers’ Confederation of Thai Trade and Industry (EconThai), said the export sector, which is traditionally Thailand’s driving force, remains weak, so supply chains have been affected.

The industrial sector’s production is at 60% of its total capacity due to low purchasing power from the local and foreign markets.

As a result, the service, logistics, labor, and transport sectors are all suffering from this slowdown of economic activity.

Global factors, such as the trade war between China and the US and tensions in the Middle East — specifically attacks on shipping vessels in the Red Sea — have worsened the situation for entrepreneurs.

Weak consumer spending due to a high level of household debt in the country has brought an unpleasant situation for manufacturers and posed liquidity risks for businesses.

“Only the tourism industry seems to be surviving, but the sector makes up for 8% of the country’s GDP,” he said.

On foreign investments, he said businesses make long-term investment plans, which are not likely to be halted solely by political issues.

Last year saw investment values of more than 600 billion baht, of which 70% was the result of foreign direct investment.

Govt ‘sitting on its hands’

Mr. Tanit said the government has barely done anything in the past nine months. Instead of suspending debt payments and rolling out a stimulus program to boost liquidity, the government chose to wait for the digital wallet scheme.

“The prime minister comes from the business sector and he should have got to work immediately. He knows household debt is pressing, and businesses need debt payment suspensions and a small stimulus to keep them going. He thinks like a politician, not a businessman,” he said.

The businesses most desperate for assistance are car manufacturers whose supply chain has experienced a 23% contraction, he said, adding that other struggling sectors include rubber products, cassava products, and sugar.

Half of export clusters have also contracted, and without government intervention, the supply chain will be dragged down, he noted.

While waiting for the digital wallet rollout, the government should devise a program to stimulate public spending and generate more production. Operating at 50–60% of their total capacity, businesses will not be able to retain workers, he said.

“Can the government suspend debt payments for a year too? This is a short-term measure. And for the digital wallet, the government should ensure it can be spent anywhere, not just in convenience stores,” he said.

Deputy Finance Minister Paopoom Rojanasakul’s perspective

Deputy Finance Minister Paopoom Rojanasakul said the ruling party has always maintained that the country faces economic stagnation and the digital wallet handouts are intended to jolt the economy back from its slumber.

Mr. Paopoom blamed the sluggish economy on three elements: the delay in implementing the 2024 fiscal budget; inefficient fiscal and monetary tools to stimulate the economy, with private sector confidence waning and consumers holding back on spending; and contraction in loans, especially for small and medium-sized enterprises (SMEs).

“In short, the fiscal sector lacks ammunition, and while the monetary sector has it, it refuses to use it. This results in banks being cautious about extending loans. With all these elements, the country’s economy is sluggish,” he said.

State funds kick in

Mr. Paopoom said that since the 2024 fiscal budget bill was finally passed after a long delay, funds have been injected into the system.

Additionally, measures are now in place to accelerate investments in state enterprises which meet 95% of the government’s target.

The fiscal 2025 budget is set to take effect in October this year, and coupled with the rollout of the digital wallet scheme, more funds will be injected into the system.

Regarding the outflow of foreign capital, the deputy finance minister said Thailand has lost its appeal due to a lack of consumption and slow production rates.

He admitted that political stability is also a factor in businesses’ decision-making. He expressed confidence the government is on the right track to address the economic problems and it has implemented a raft of fiscal measures, including tax incentives, soft loans and upcoming loan guarantee measures.

Central bank must play a role

He said the government needs cooperation from the Bank of Thailand to implement its measures, while stressing that interest rate cuts are necessary.

“We have remained firm on the need for a reduction in interest rates, which are not aligned with the economic conditions. With the current inflation rate at 0.6–0.7%, which is below the lower threshold of 1%, interest rates look higher than they are supposed to be.”

Mr. Paopoom added the economy is poised to get back on track, especially in the second half of this year, and much-needed reforms such as the Virtual Bank project, credit guarantee upgrades and the retirement lottery policy are in the pipeline.

I think Mr. Nonarit’s optimism is misplaced. The Thai economy has too many structural issues that a few interest rate cuts won’t solve.

But interest rate cuts can stimulate spending and investment, which is exactly what we need right now, don’t you think?

It’s a short-term solution at best. We need comprehensive reforms, not band-aid fixes.

Structural reforms take time. We need immediate relief too, and interest rate cuts can provide that immediate boost.

Agreed Alex, interest rate cuts won’t address the underlying issues like high household debt and weak exports.

The political instability makes me skeptical. If Srettha Thavisin gets removed, it could disrupt any positive momentum the economy might gain.

Thailand has survived political turmoil before, and we’ll get through this. The economy is resilient.

True, but this time it seems more critical. We’re dealing with a global downturn too.

Why are we focusing so much on international investors? We should be supporting local SMEs more.

Foreign investment brings in much-needed capital and can create jobs. SMEs are important, but we can’t ignore international funds.

I agree with Suda. SMEs are the backbone of our economy. More support should go to them.

Thank you! If we empower SMEs, the economic benefits will be more evenly distributed.

The digital wallet scheme sounds promising, but will it be enough to kickstart the economy?

Promising but risky. It could easily lead to more debt without actual economic growth.

The key will be in its implementation. If it’s mismanaged, it could be disastrous.

We really should focus on educational reforms and workforce development. That’s the long-term solution.

Indeed, but we also need immediate solutions to get through the current crisis.

Immediate solutions are necessary, but not at the expense of long-term growth.

Reforms always get postponed because of immediate crises. The cycle never ends.

If global factors don’t improve, no amount of local policy will save us.

Thailand’s manufacturing sector is operating at only 60% capacity. That’s alarming!

I find it ironic that the tourism industry is one of the few surviving sectors, yet it only makes up 8% of GDP.

Debt suspension sounds great in theory but could harm future financial stability.

If the government doesn’t act soon, we might see a massive increase in unemployment.

The global trade war and Middle Eastern tensions really complicate things. It’s not just our internal issues.

Why is the government so slow in rolling out policies? We need faster action.

The industrial sector’s low production capacity means layoffs are inevitable if there’s no demand.

The central bank really should play a more active role. Interest rates are too high.

Foreign capital outflow is a huge issue. We need policies to keep this money in Thailand.

The government’s current measures aren’t sufficient. We need more aggressive fiscal policies.

This whole situation shows why we need politicians with real-world business experience.

I feel like all this talk of recovery is just political rhetoric. Show me the results.