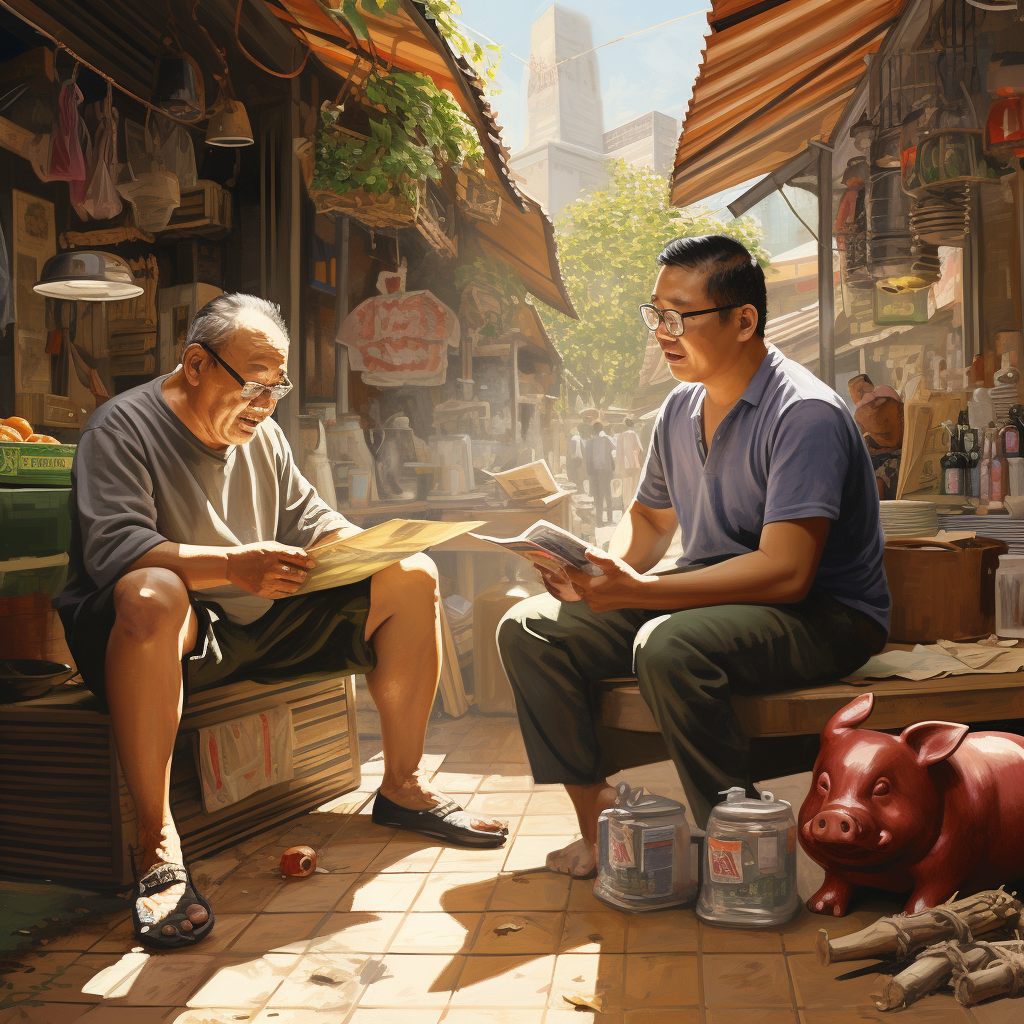

Picture this: It’s a typical sunny afternoon in Thailand, with the hustle and bustle of people energetically going about their day. Amidst the liveliness, there’s an undercurrent of concern gripping nearly half the working age population – retirement readiness, or the stark lack thereof. A recent survey, canvassing a robust sample of 2,400 Thais who are still in the workforce, paints a rather troubling picture. Alas, only 49.3% of these diligent souls have their financial ducks in a row for the golden years, unveiled Prof Wilert Puriwat, the esteemed dean of Commerce and Accountancy faculty, last Monday.

As we delve into these figures, it becomes abundantly clear that a staggering 50.7% may just find themselves in quite the pickle, unprepared as they come face to face with retirement. “And it’s not just about sunny vacations and spoiling the grandkids”, quips Prof Wilert. “With the twilight years come mounting medical bills that could spell out financial woes for our seniors.” The forum, brimming with eager minds, was aptly named “National Policy for Financial Readiness”. The venue? Hosted by Prof Wilert’s faculty alongside the visionary Capital Market Development Fund.

Now, Prof Wilert isn’t just about dissecting problems; he’s a beacon of solutions, too. With the winds of change indicating an ageing Thai society, he’s calling upon the government to take a bold stance. It’s time for a policy overhaul – the priorities? Drumming up public education in savvy financial planning and investment strategies, sharpening the everyday Joe’s financial acumen, and engraving the ethos of saving deep into the Thai psyche.

And it’s not all doom and gloom, folks! Prof Wilert was quick to highlight a silver lining – a sly uptick in the percentage of those financially groomed for retirement, a wee bit higher than what the stats showed back in 2021. “We’re seeing progress, more Thais are getting on the boat of financial stability,” he notes with cautious optimism.

Enter stage-right: Santitarn Sathirathai, a brilliant mind on the Bank of Thailand’s Monetary Policy Committee. He graced the forum with insights that the digital age is beckoning, and it’s calling for digital banking mastery. With a nod to the unstoppable digital tide, he states, “The shift to digital banking is not just coming; it’s here, and how!” The government is not resting on its laurels – it’s rolling out efforts left and right to polish the people’s digital banking skills while throwing up a fortress against the bogeyman of cyber threats.

All in all, the forum wasn’t just a gathering; it was a clarion call to action. As the digital wave surges forward and the shadow of retirement looms larger, Thailand braces itself to educate, empower, and enrich the financial well-being of its citizens. Because when the hustle and bustle slows and the sun sets on those working days, financial peace of mind is that blissful hammock every Thai deserves to lie in.

Be First to Comment