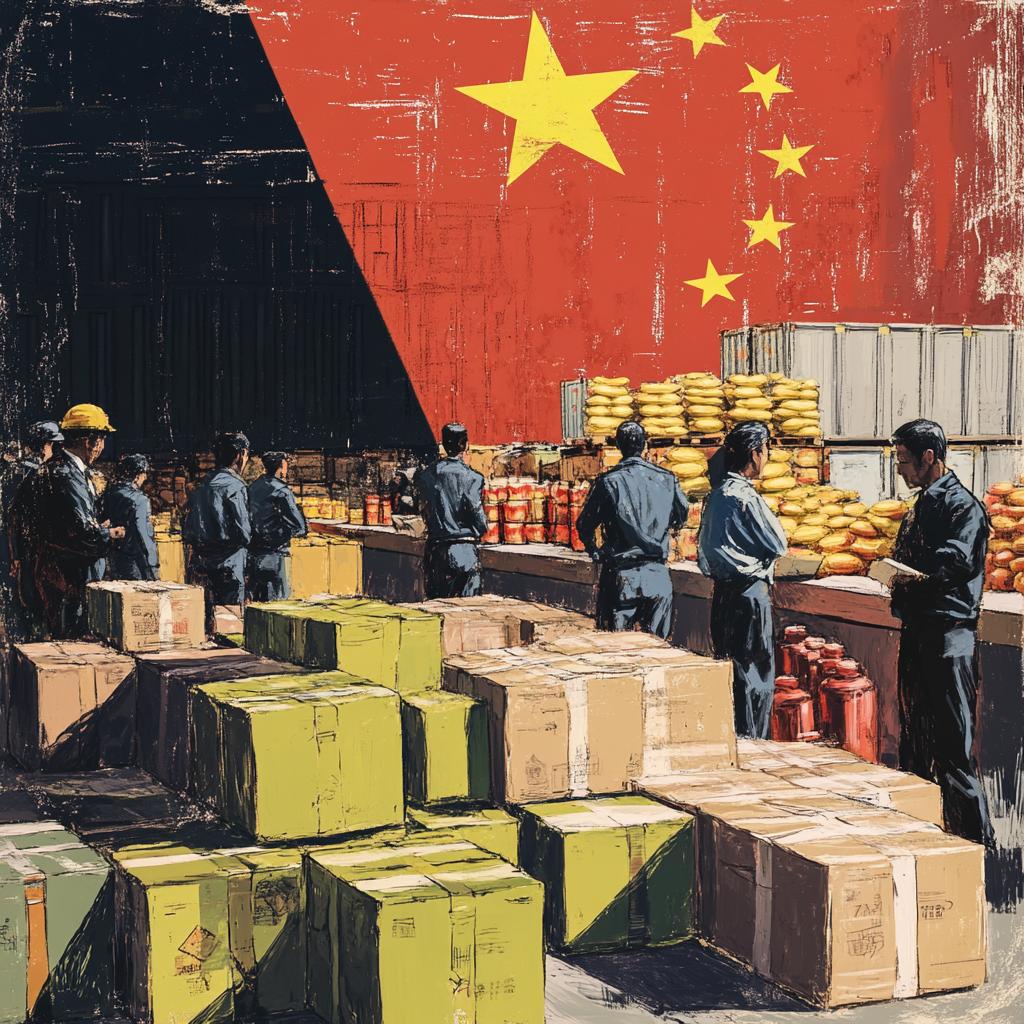

In a dramatic development, China has thrown down the gauntlet by halting the import of nineteen Thai products, including the much-loved sweetened condensed milk. Labeling issues and safety concerns were cited as reasons in a bold move that mirrors a determined crackdown from China, which recently turned away 357 shipments from 38 nations in January alone. The ripple effect of this decision has reverberated through Thailand’s vibrant export sector, prompting a wave of anxiety and introspection.

The General Administration of Customs of China (GACC) rang the alarm bells on February 19, unveiling the list of rejected imports. At the helm of this rejection parade was the United States, with a hefty 83 shipments (a glaring 23.2%) being sent back, predominantly involving alcoholic beverages and dietary supplements. Malaysia, the land known for its bird’s nest delicacies, followed closely with 36 shipments (10.1%) getting cold-shouldered. The Philippines faced the music with 22 shipments (6.2%) rejected, chiefly from grain products. Thailand, the land of smiles and sumptuous sweets, found itself on this grim list, holding the fourth position with 19 shipments (5.3%) turned away, including its cherished sweetened condensed milk. Meanwhile, Denmark wrapped up the top five with 18 rejected shipments (5%), mainly meat products.

What, you ask, were the grievances that led to such a whopping set of rejections? The GACC left no room for ambiguity: incorrect labeling claimed the lion’s share of the blame at 25.5%, failure to meet the rigorous Chinese safety standards took second place with 17.9%, discrepancies in certificates hovered at 15.7%, while insufficient documentation (8.9%) and issues with overseas manufacturer registration (6.2%) completed this not-so-illustrious checklist.

This is not a novel tale for the Thai export domain. In a rather unsettling déjà vu, back in December 2024, China had already raised the red flag against Thailand’s sugar syrup and premixed powder imports due to factory hygiene concerns. This resulted in Thai businesses swallowing a financial bitter pill, with losses projected to soar perilously close to US$59 million. Factories suffered the silent treatment for over two tense months, leaving about 40,000 tonnes of syrup and premixed powder shipments to return home, only to be welcomed with harsh shipping fees, add-on transport costs, and fines at Chinese ports.

The Thai Sugar Product Association, caught between hope and despair, has called upon the government to untangle this diplomatic and economic knot by engaging Chinese authorities in dialogue to politely dismiss the ban. Slow progress, however, has only multiplied concerns, standing as a dire warning that failure to resolve these issues could potentially obliterate a million metric ton demand in Thai sugar, pulling down domestic prices and shaking the foundations of the industry.

The detail list of the banned products remains somewhat under wraps, but colorful whispers in the market echo a few key players:

- Sugar Syrup and Premixed Powder: Becoming essentially infamous, these products faced the spotlight for factory hygiene deficiencies, which packed a financial punch that had entrepreneurs wincing at up to US$60 million in losses.

- Poultry Products: The fright of bird flu reared its ugly head again with China reinstating its ban on Thai poultry. October 27 marked the black date from which all poultry foodstuffs would see a cold reception of returns or outright destruction.

- Longans: Come August 13, 2021, and Thailand’s succulent longans were indefinitely blackballed thanks to pesky mealybugs wreaking havoc in shipments, significantly choking Thai longan exports considering China was a golden market for these beloved fruits.

China’s tightening grip on import protocols serves as a stern wake-up call for Thai exporters, urging an undeniable need to raise their standards. Compliance with China’s unforgiving safety and labeling mandates is not simply advised; it is utterly indispensable for keeping Thai products within China’s welcoming borders, thus preserving the nation’s plenty-inspiring export economy.

Wow, I can’t believe China stopped importing Thailand’s sweetened condensed milk! That’s bad for Thai businesses.

They probably have good reasons. Safety and health concerns should come first, right?

True, but I wonder if it’s really about safety or if there’s something more political going on here.

It would be wise for Thailand to align their standards with those of China to avoid such future issues.

China is making a point here about quality control, but it feels like they’re also flexing their muscles economically.

I think it’s high time Thailand improves its labeling and safety standards. If they don’t, this won’t be the last rejection.

It must be tough for small businesses to comply with all these standards though.

I live for Thai foods; this news breaks my heart. But if safety’s an issue, then it’s justified.

Yes, safety is paramount. However, it affects the entire export economy unfairly because of a few rotten apples.

I agree, but this can push improvements across the board. A blessing in disguise perhaps.

China’s demands might be a bit exaggerated. Every country has some product rejections, isn’t it normal?

Not when it’s 357 shipments in one month! That’s a huge number, which indicates serious issues.

True, maybe there’s a larger trend of tightening global regulations we all need to adapt to.

Thai economy is in for a rough ride unless it finds alternative markets to China. Diversification is key here.

Seems like political tension might be influencing economic decisions. China’s aggressive stand raises questions.

Hope Thailand resolves these issues soon. Losing out on a market like China will be devastating long-term.

Maybe they should engage China in dialogue soonest; there’s so much at stake.

Am I the only one loving sweetened condensed milk this much? Sad to see it caught in trade wars.

You’re not alone! It’s one of those pantry staples that just makes everything better.

Closer inspection and higher standards in production can avert future crises like this. Thailand needs to adapt.

But why only now? Weren’t standards a concern before?

Indeed, but global standards are evolving. It’s about syncing with them more rapidly now.

Will this affect tourism to Thailand somehow? It seems everything is connected.

Sounds like politics disguised as ‘safety concerns’ to me. Who really benefits from this ban?

Maybe China is doing this to encourage domestic or alternative foreign products?

Every market has rules, China’s just enforcing it strictly. Thailand should see this as a call to modernize.

As tragic as it seems, Thailand’s robust plans need a reform. Import rejections are alarm bells.

Correct, imports and exports make a national economy’s artery. Implementing better measures controls the flow.

This could push Thailand towards more regional partnerships, redirecting exports to nearby countries.

I’d love to hear from Thai businesses directly impacted by this. What next steps are they considering? Any insider perspectives?