Thailand’s 2026 election is doing something it always does best: capturing attention at home and abroad while quietly rewriting the economic and political playbook. Investors, tourists, and regional neighbours are all leaning in, not just to see who will sit in the palace of government, but to gauge the direction of the country’s growth, stability, and international posture as it navigates a complicated global landscape.

Why the world is watching

Foreign institutions aren’t tuning in for the campaign slogans — they’re watching for signals. Will the incoming administration champion continuity, or will it retool policy to accelerate Thailand’s move into higher-value, tech-driven industries? The answers will shape everything from stock market mood swings in Bangkok to long-term Foreign Direct Investment (FDI) flows.

Analysts expect a short-term lift for markets — the so-called “January effect” combined with election optimism often nudges equities higher. But beyond the immediate bounce, what matters is clarity: clear policy direction reduces investor uncertainty, and certainty is a currency investors spend freely.

Economic levers and foreign investment

Thailand’s investment story is a mix of old strengths and new ambitions. Traditional export sectors are still vital, but the kingdom is increasingly betting on its “S-curve” industries — electric vehicles, data centres, and semiconductors — to move up the value chain. These sectors offer a compelling proposition for global investors looking for growth in resilient, tech-forward markets.

- Market sentiment: Expect short-term volatility around election events, followed by stronger market confidence if the new government sends consistent policy signals.

- Trade and tariffs: Thailand faces hurdles — notably a 19% tariff on some Thai imports to the U.S. — which could pressure certain exporters. Still, shifting focus to high-tech manufacturing and services can offset these disadvantages by attracting higher-value FDI.

- Government support: Bangkok continues to court investors with incentives aimed at innovation-led growth. Policies that prioritise research, infrastructure, and regulatory ease will be decisive in luring global capital.

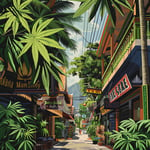

Tourism: the essential engine

Tourism isn’t just a headline metric for Thailand — it’s economic oxygen. Authorities are targeting about 36.7 million visitors in 2026, a number that speaks to recovery and ambition. But getting there requires attention to the details travellers increasingly care about.

Aviation service fees and higher departure taxes are nudging travel costs upward, and that could bite if visitors begin to hunt for cheaper alternatives. The government’s solution is twofold: ensure that any cost increases are offset by premium services and a frictionless visitor experience, and market Thailand as a destination for higher-value travellers who are less price-sensitive and more attracted to unique experiences, safety, and quality.

Speaking of safety, the next administration is expected to prioritise national security as part of a tourism-enhancement strategy. Better safety standards and visible security measures help attract quality tourists and lock in the kind of repeat visits that boost local economies from Phuket to Chiang Mai.

Geopolitics and national security

Regional tensions and border dynamics have raised the volume on security conversations. Thailand is responding with a blend of local management and broader diplomatic engagement — leaning into regional cooperation and international norms rather than unilateral approaches. That balance matters: businesses and tourists alike prize predictability, and cooperative solutions help insulate Thailand from spillover risks.

The constitutional referendum: a foundational step

Alongside the general election, Thais will vote on a constitutional referendum on 8 February 2026. Importantly, this isn’t a verdict on a final constitution — it’s a yes-or-no on whether the country approves the process to draft a new one, as required by the Constitutional Court. Think of it as voting to start the engine of reform rather than choosing the car.

This procedural vote signals a commitment to public consultation and reform. If handled transparently, the referendum could strengthen political stability and boost civic engagement — two factors that foreign observers and investors watch closely. A clear, legitimate process can be as important to market confidence as any fiscal policy announcement.

Looking forward: a pragmatic optimism

Thailand’s 2026 election isn’t an endpoint; it’s a pivot. The choices made by the next government will determine whether the country doubles down on continuity or accelerates into new economic frontiers. With the right mix of policy clarity, investment in S-curve industries, tourism revitalisation, and a steadying hand on security and governance reforms, Thailand is well-positioned to attract capital, drive sustainable growth, and enhance resilience.

For investors and visitors alike, the message is simple: Thailand is open for business — and it’s reinventing itself in ways that could make it an even more attractive place to invest, visit, and watch. Whether you’re an entrepreneur eyeing the semiconductor boom, a traveller looking for safer, richer experiences, or simply someone curious about democracy in motion, keep your eyes on Bangkok and the ballot boxes in February — the next chapter is being written now.

Interesting piece — investors love signals more than slogans, and Thailand keeps sending mixed ones. The focus on S-curve industries is smart, but policy continuity matters more than shiny announcements. I worry the tariff issues and half-baked reforms will scare off long-term FDI unless the new administration moves fast.

Tariffs? Tell that to my exporter cousin, he’s been squeezed for months. Thailand needs real factories, not just fancy data centres.

The market reaction will be predictable: short-term bump, then a refocus on fundamentals. Investors will watch clarity on tax, R&D incentives and land-use rules. If policies align with incentives, semiconductors and EVs could boom.

Sounds technical — but who pays for all that R&D?

Good point, Tom — the financing is the rub; public-private partnerships could help. I’ll be watching the budget announcements closely.

PPP sounds like a pig in a poke unless transparency improves.

I think the referendum is the real story here, not just the election. A transparent process could calm investors and tourists alike, but if it looks staged, capital will flee. The palace and military influence still loom large.

You can’t ignore the military’s role after decades of coups. Voters want economic hope, not power plays.

Exactly, Nina — legitimacy drives markets.

Markets sometimes overreact to institutional risk; but Thailand’s fundamentals (tourism, manufacturing) are still solid. The key is judicial independence and predictable regulation. Foreign firms will hedge, not exit, if the legal framework is respected.

If courts and regulators prove impartial, that hedging becomes investment, not flight.

Tourism numbers are the only thing families around me care about.

That’s honest — tourism is lifeblood for many towns. But rising departure taxes could push budget tourists to Vietnam or the Philippines.

Yeah, and those small businesses rely on repeat visitors. If Bangkok markets itself as pricey, they’ll lose the backpacker crowd.

Or they’ll try to attract wealthier tourists and lose cultural authenticity.

I keep hearing ‘S-curve’ like it’s a religion. Data centres and semiconductors are great, but who is going to train the workers? Don’t forget environmental and local community costs.

Excellent point. High-tech FDI requires human capital upgrades that take years and deliberate education policy. Also, energy and water demands of data centres have serious environmental trade-offs. Policymakers should build broadband and sustainable power in tandem with incentives.

So where’s the plan? Words aren’t enough.

I’ve worked near a new plant and locals saw jobs, but also pollution. Regulations need teeth, not just promises.

The article underplays social inequality risks if growth skews tech-heavy. High-value FDI can create pockets of prosperity while leaving rural areas behind. The government needs regional development plans.

Agree, Ana, decentralisation matters. Train rural youth for tech jobs and offer incentives for companies outside Bangkok.

Exactly — otherwise we get a two-speed economy.

Will I be safe visiting Thailand next year?

Short answer: most tourists will be fine, but stay aware of local advisories. The new government seems serious about visible security to reassure visitors, which helps tourism receipts. Always buy travel insurance.

Okay thanks, I’ll bring my parents’ insurance papers.

As an investor, I want policy consistency and tax clarity, not slogans. Tariff headaches make me think of moving assembly elsewhere, unless incentives for semiconductors are world-class. Watch for land rights and free trade zone rules.

Thailand can’t expect to leapfrog with only tax holidays; infrastructure and rule-of-law are essential. The US tariff issue is a wake-up call to diversify markets.

Diversification is code for losing China discount — tough sell to factories. But Asia supply chains are changing, and Thailand could be a winner with right reforms.

I agree with Chai and Larry D — concrete legal protections for foreign IP would sway my fund. If Bangkok shows serious regulatory reform, capital will follow.

Geopolitics can’t be separated from economic choices here. Thailand’s balancing act between great powers affects FDI risk assessments and tourism flows. Regional cooperation is positive, but overdependence on any single partner is risky. The referendum’s legitimacy will be assessed by foreign capitals as much as by locals.

Good point, Meera — investors run scenario analyses on geopolitical shocks. A credible, transparent constitution drafting process reduces tail risk. Tourists prefer predictable, safe destinations without visible tensions.

Exactly — predictability is undervalued in markets. Policymakers underestimate the premium that steady governance brings.

I want cheaper flights, not geopolitics. Raise tourist value with better services, not more police tape. But if safety improves, I’ll pay more.